Loading

Get Ma Nonresident Fiduciary Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ma Nonresident Fiduciary Return Form online

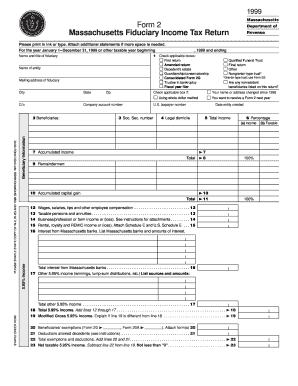

Completing the Ma Nonresident Fiduciary Return Form is essential for properly reporting fiduciary income in Massachusetts. This guide will provide you with clear, step-by-step instructions for filling out the form online.

Follow the steps to successfully complete the Ma Nonresident Fiduciary Return Form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- In the first section, enter the name and title of the fiduciary, along with the entity name and mailing address. Ensure accurate completion to avoid processing delays.

- Check any applicable boxes, such as whether you are filing an amended return, a final return, or if it pertains to a decedent's estate. This classification will affect the processing of your return.

- Complete the beneficiary information section, including the names, social security numbers, and details about any nonresident beneficiaries. This information is crucial for tax computation.

- Fill out the income details carefully, reporting wages, pensions, business income, rental income, and other relevant sources. Attach supporting documentation where necessary.

- Calculate the total income and apply any exemptions or deductions that apply. Include the required forms for exemptions and ensure the totals are calculated accurately.

- Review the tax computation section where you calculate the total taxable income and applicable tax amounts. Double-check all calculations to ensure compliance.

- Sign and date the form in the appropriate sections. If a preparer is involved, their signature and identification number must also be included.

- Once completed, save your changes, and download or print the form as required. Ensure to keep a copy for your records before submitting.

Start filling out your forms online today and ensure your fiduciary income tax is filed accurately.

The Massachusetts non-resident tax return form, known as Form 1 NR py, is designated for individuals who earn income in Massachusetts but reside elsewhere. This form facilitates the reporting of income and deductions specific to non-residents. Accurately completing this form ensures that you adhere to state tax regulations. For a smoother process, consider using the Ma Nonresident Fiduciary Return Form to guide you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.