Loading

Get Cuny W2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cuny W2 online

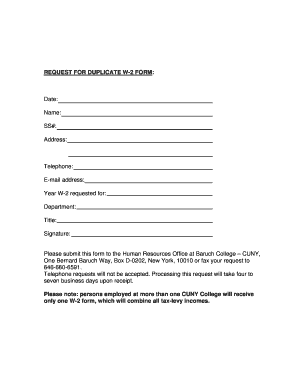

Filling out the Cuny W2 form online can simplify the process of requesting a duplicate for your tax records. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to accurately fill out your Cuny W2 form.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- In the first section, enter the date on which you are filling out the form. This is important for record-keeping purposes.

- Next, provide your full name in the designated field. Ensure that it matches the name on your official records.

- Input your Social Security Number (SS#) in the specified section. Double-check this entry for accuracy, as it is crucial for your W-2 processing.

- Fill in your current address, including the street, city, state, and zip code. This ensures that the Human Resources Office can reach you if necessary.

- Enter your telephone number and email address in the appropriate fields. This information is useful for communication regarding your request.

- Indicate the year for which you are requesting the W-2 form. It's essential to specify the correct year to avoid delays.

- Provide the name of your department and your job title in the corresponding sections.

- Lastly, sign the form to authorize your request. This step validates your application, confirming that you understand the request is official and cannot be submitted via telephone.

- After completing the form, review all entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as necessary.

Take action now and fill out your Cuny W2 form online to ensure you receive your tax information promptly.

To access your NYS W-2, log in to your employer's online payroll system or check with the New York State Department of Taxation and Finance. For CUNY employees, the easiest way is through CUNYfirst. Ensure you have your login information ready to streamline the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.