Get Schedule Ct-si, Nonresident Or Part-year Resident Schedule Of Income From Connecticut Sources

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule CT-SI, Nonresident Or Part-Year Resident Schedule Of Income From Connecticut Sources online

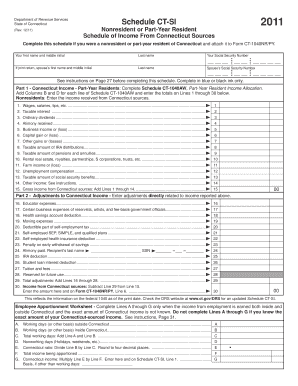

Filling out the Schedule CT-SI is a vital step for individuals who are nonresident or part-year residents of Connecticut, as it helps in reporting income derived from Connecticut sources. This guide provides clear, step-by-step instructions to assist users in accurately completing this form online.

Follow the steps to effectively complete your Schedule CT-SI.

- Click ‘Get Form’ button to obtain the schedule and open it in your browser.

- Carefully enter your first name and middle initial in the designated fields at the top. Then, input your last name.

- If you are filing a joint return, provide your spouse's first name, middle initial, and last name in the respective fields.

- Fill in your Social Security Number in the space provided. Make sure to double-check that it is entered correctly.

- If applicable, enter your spouse's Social Security Number accurately in the adjacent space.

- In Part 1, entitled Connecticut Income for part-year residents, refer to Schedule CT-1040AW to allocate your income. Sum Columns B and D for each line of the Schedule and input the totals for Lines 1 through 30.

- For nonresidents, list your income received from Connecticut sources by entering amounts for various income types such as wages, taxable interest, and business income in the corresponding lines.

- Complete Part 2 for Adjustments to Connecticut Income by providing any relevant adjustments directly related to the income reported above, including educator expenses and health savings account deductions.

- Calculate the total adjustments on Line 29 by adding all entries in Lines 16 through 28.

- Finally, subtract Line 29 from Line 15 to determine your income from Connecticut sources and enter this amount on Line 30. Ensure this figure matches the corresponding line on Form CT-1040NR/PY.

- After filling out the form, review all entered information for accuracy. You can now save your changes, download, print, or share the completed form as needed.

Complete your Schedule CT-SI online today to ensure accurate reporting of your income from Connecticut sources.

The Schedule CT is a tax form used by nonresidents and part-year residents to report income sourced from Connecticut. This form, officially called the Schedule CT-SI, Nonresident Or Part-Year Resident Schedule Of Income From Connecticut Sources, helps you detail your Connecticut income and calculate the appropriate state tax owed. Using this schedule is important for ensuring you meet your tax obligations effectively and accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.