Loading

Get It 21026 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-2102.6 Form online

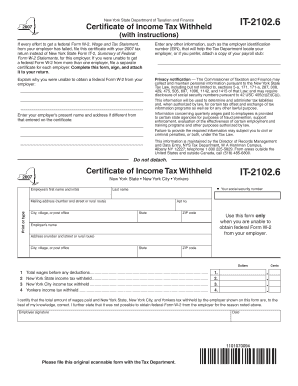

The IT-2102.6 Form is a Certificate of Income Tax Withheld provided by the New York State Department of Taxation and Finance. This guide will help you navigate the online process of completing this form when you are unable to obtain a federal Form W-2 from your employer.

Follow the steps to complete the IT-2102.6 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your digital editor.

- Enter your personal information, including your first name, middle initial, last name, and social security number. Ensure that all entries are accurate.

- Provide your mailing address, which includes the street address, city or village, state, and ZIP code.

- Input your employer's name and address. If this information differs from what was previously entered, ensure to update it.

- Complete the wage details, including total wages before deductions, state income tax withheld, New York City income tax withheld, and Yonkers income tax withheld. Enter amounts in dollars and cents.

- In the certification section, read the statement carefully to ensure that the provided information is correct. Confirm your understanding by signing and dating the form.

- Finally, save any changes made to the form. You can download, print, or share the completed form as needed.

Complete your IT-2102.6 Form online today!

Related links form

Form 26A PDF is the portable document format version of the form used for declaring income. This format makes it easy to view and share electronically while maintaining the integrity of the document. When preparing your records, be sure to refer to the data in the It 21026 Form for thoroughness.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.