Loading

Get Dd Form 2210

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Dd Form 2210 online

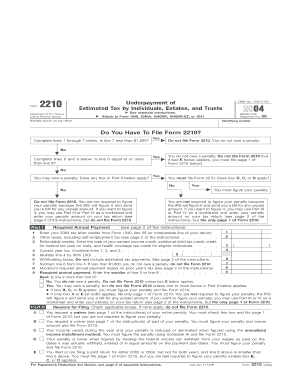

Dd Form 2210 is used to determine a penalty for underpayment of estimated tax by individuals, estates, and trusts. This guide provides a clear, step-by-step approach to filling out the form online, ensuring users can easily navigate each section and field.

Follow the steps to successfully complete the Dd Form 2210 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with the first section, 'Date' and 'Name(s) shown on tax return.' Enter the relevant information to identify the tax return associated with this form.

- Next, assess if you have to file Form 2210. Complete lines 1 through 7, following the prompts to determine if your underpayment liability is less than $1,000.

- If prompted by line 7, select the appropriate box that describes your situation. Choose if you do not owe a penalty or if you are obligated to file based on your responses.

- Proceed to Part I where you will input your tax data. Line 1 requires the 2004 tax after credits from Form 1040, followed by other relevant taxes and credits in lines 2 and 3.

- Line 4 requires you to combine the amounts from lines 1, 2, and 3. In line 5, calculate 90% of the amount from line 4.

- In line 6, record your withholding taxes, excluding estimated tax payments. Calculate the difference in line 7 to ascertain if you owe a penalty.

- Continue to Part II, where you will check applicable boxes that justify your reason for filing the form, should you qualify.

- If necessary, proceed to Parts III and IV to detail your underpayment calculations using the short or regular methods, based on your situation.

- Once all sections are completed, make sure to save your changes. You can download, print, or share the completed form as needed.

Complete your Dd Form 2210 online today to ensure compliance with tax obligations.

TurboTax may prompt you for the Dd Form 2210 if it detects that you've underpaid your taxes during the year. This form helps calculate any potential penalty. By responding to this prompt, you can ensure compliance with IRS rules and avoid surprises when filing your taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.