Get Clergy Housing Allowance Calculation Form For Ministers Who - Uua

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Clergy Housing Allowance Calculation Form for Ministers Who - Uua online

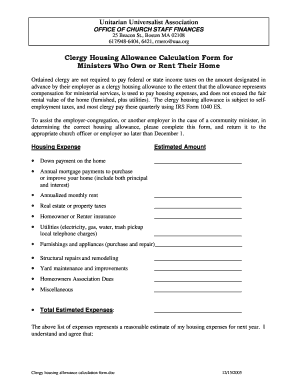

This guide provides clear instructions on how to effectively complete the Clergy Housing Allowance Calculation Form designed for ministers. Ensuring accurate information on this form is essential for determining your housing allowance accurately.

Follow the steps to complete your form online.

- Click ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Begin by entering your estimated housing expenses. This includes details such as the down payment on your home, annual mortgage payments, and monthly rent. Be sure to provide accurate and reasonable estimates for each category.

- Continue filling out the form with additional housing expenses, including real estate taxes, homeowner or renter insurance, utilities, furnishings and appliances, and any structural repairs needed. Ensure all sections are completed to give a full picture of your housing situation.

- Once you have filled out all the housing expenses, review your total estimated expenses at the bottom of the form to ensure accuracy.

- In the acknowledgment section, sign and date the form to confirm that the information provided is accurate. Note that your employer will require this completed form before designating a housing allowance.

- After completing the form, save any changes made, and prepare to download or print the document for submission. You may also want to share the completed form with your employer if necessary.

Complete your Clergy Housing Allowance Calculation Form online today to ensure your housing expenses are appropriately reported.

Clergy must report their housing allowance on their tax returns as part of their total income, but they must ensure it is accounted for correctly. The Clergy Housing Allowance Calculation Form For Ministers Who - Uua simplifies this process by providing clear instructions for reporting. This aids in maintaining compliance with IRS regulations while maximizing the allowance's benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.