Loading

Get It 203 C

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT 203 C online

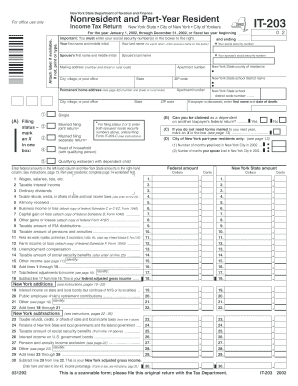

Filling out your IT 203 C can be straightforward if you follow the right steps. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your IT 203 C form online.

- Press the ‘Get Form’ button to access the IT 203 C form in an online editor.

- Begin by entering your personal information at the top of the form. This includes your name and social security number, followed by your spouse's details if applicable.

- Scroll down to specify your mailing address, ensuring that all fields are filled out correctly, including city, state, and zip code.

- Choose your filing status. Mark the appropriate box for 'Married filing joint return,' 'Married filing separate return,' or 'Head of household.'

- Proceed to report your income. Input your wages, salaries, and any other income sources in the designated fields, and attach relevant schedules as instructed.

- Calculate your total income by adding the fields from the previous step. Ensure to follow any specific instructions for deductions or adjustments stated in the form.

- Continue through the form, entering any applicable federal and New York State adjustments as specified in the instruction sections.

- Carefully review all entries. Once satisfied, save your form and consider options for downloading, printing, or sharing it, as needed.

Complete your IT 203 C form online today for a smooth filing experience!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To fill out a tax withholding form accurately, start by providing your personal information, including your filing status and number of allowances. Evaluate your financial situation to determine how much should be withheld. If unsure, consider using IRS guidelines or consult a tax specialist to optimize the form for your individual needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.