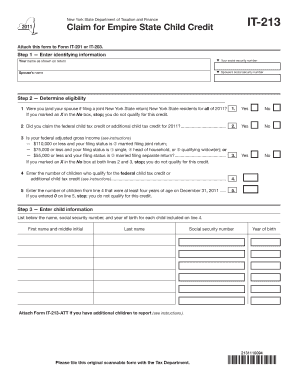

Get It-213 New York State Department Of Taxation And Finance Claim For Empire State Child Credit Attach

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-213 New York State Department Of Taxation And Finance Claim For Empire State Child Credit Attach online

Completing the IT-213 form is essential for claiming the Empire State Child Credit in New York. This guide offers step-by-step instructions to help users accurately fill out the form online, ensuring compliance and maximizing potential credits.

Follow the steps to successfully complete the IT-213 form.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Begin by entering your identifying information in the specified fields. Provide your name as it appears on your tax return, your social security number, your spouse's name, and their social security number if applicable.

- Determine your eligibility by responding to the questions regarding residency, federal child tax credits, and adjusted gross income. Mark 'Yes' or 'No' as appropriate. If any of the responses disqualify you for the credit, you can stop filling out the form.

- Complete the child information section by listing the name, social security number, and year of birth for each qualifying child. Ensure that you attach Form IT-213-ATT if you have additional children.

- Proceed to compute the credit. If you did not claim any federal child tax credits, simply enter 0 in the designated line and continue with line 14 if applicable. For the calculation, enter the amounts from your federal forms and follow the mathematical prompts shown.

- If applicable, fill out the sections for spouses filing separate New York State returns, including necessary amounts and references to other forms as instructed.

- After completing all relevant sections, carefully review your entries for accuracy. You can then save changes, download, print, or share the completed form as needed.

Get started on your IT-213 form online to ensure you claim your Empire State Child Credit today.

To claim the New York State resident credit, taxpayers use the IT-150 or IT-201 form, depending on their tax situation. This form allows you to report your income and calculate your credits accurately. Additionally, if you are claiming the Empire State Child Credit, you'll need to attach the IT-213 New York State Department Of Taxation And Finance Claim For Empire State Child Credit Attach. By following the instructions carefully and using the correct forms, you can ensure you receive the credits you deserve.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.