Loading

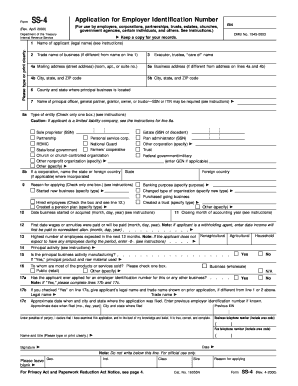

Get Form Ss-4 (rev. April 2000), ( Fill -in Version)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form SS-4 (Rev. April 2000), ( Fill-in Version) online

This guide will assist users in completing the Form SS-4 online, ensuring an accurate and efficient application process for obtaining an Employer Identification Number (EIN). Following these instructions will help clarify submissions and requirements for various entities.

Follow the steps to accurately complete the Form SS-4 online.

- Use the ‘Get Form’ button to access the Form SS-4 and open it in your preferred digital editing tool.

- In line 1, enter the legal name of the entity applying for the EIN exactly as it appears on legal documents. If you are an individual, include your first name, middle initial, and last name.

- On line 2, provide the trade name of the business if it differs from the legal name stated in line 1. This is the 'doing business as' name.

- Line 3 should display the name of the executor or trustee if applicable. Print or type clearly the full name.

- Complete lines 4a and 4b with the mailing address of the entity. Include street address, room or suite number, city, state, and ZIP code.

- Use lines 5a and 5b to provide the business address if it is different from the mailing address. Ensure all information is accurate.

- In line 6, enter the county and state where the principal business is located.

- On line 7, indicate the name of the principal officer or general partner, including their SSN or ITIN as required.

- For line 8a, check the box that aligns with the type of entity applying for the EIN and ensure accurate classification.

- On line 9, specify the reason for applying for the EIN by selecting the appropriate option and providing additional details if required.

- Fill in the date your business started or was acquired in line 10, using the appropriate format.

- Complete line 11 by indicating the closing month of your accounting year.

- In line 12, provide the date when wages or annuities were first paid or will be paid.

- Provide the highest number of employees you expect in the next 12 months in line 13, entering -0- if there are no expected employees.

- Enter the principal activity of your business in line 14, describing it accurately.

- Complete lines 15-17 as necessary, answering questions regarding prior EIN applications and business activities.

- Finally, sign and date the application, including your telephone number for any inquiries, and save your changes.

Complete your Form SS-4 online today to ensure a smooth application process for your Employer Identification Number.

But, consistent with The Bluebook, the first citation should make it very clear what is being referenced, such as (Bates Jones000001) or (Bates d123-002), and subsequent consecutive cites should follow the usual practice of Id. followed by the page number, such as (Id. 000017) or (Id. -017).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.