Loading

Get Form 7ag

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 7ag online

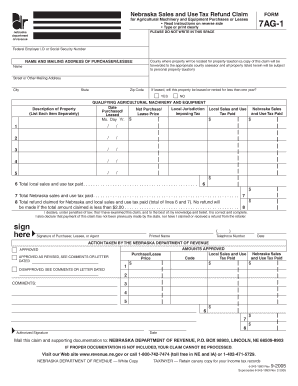

Filling out the Form 7ag for Nebraska sales and use tax refunds on agricultural machinery and equipment can be a straightforward process when you follow the right steps. This guide will walk you through each section of the form to ensure you provide accurate information.

Follow the steps to complete the Form 7ag online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, provide your Federal Employer I.D. or Social Security Number. This information is essential for tax identification purposes.

- Next, fill in the name and mailing address of the purchaser or lessee. Be sure to include the county where the property will be located for property taxation, as this information will be forwarded to the respective county assessor.

- Indicate whether the property will be leased or rented for less than one year by choosing 'YES' or 'NO' at the appropriate section.

- List each item of qualifying agricultural machinery and equipment separately in the provided fields. Include the purchase date, local jurisdiction, local sales and use tax paid, and total purchase or lease price.

- Calculate the total local sales and use tax paid and enter it in the designated field. Repeat this for Nebraska sales and use tax paid.

- Sum the totals from the previous calculations and enter the total refund claimed for both Nebraska and local sales and use taxes, ensuring the amount is at least $2.00 for eligibility.

- Review your entries and sign the form. You or an authorized person must print their name and provide a telephone number for contact.

- Save any changes made to the form, and choose to download, print, or share it as necessary. Be sure to include any supporting documentation required for processing your claim.

Complete your Form 7ag online today to claim your sales and use tax refund.

When filling out a Nebraska resale or exempt sale certificate, begin by obtaining the correct form from the state's tax authority. Fill in your details, including resale information and claim reason. Form 7ag can guide you through what's needed to complete this correctly, reducing any chance of error.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.