Loading

Get Form 5 2 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5.2 Fillable online

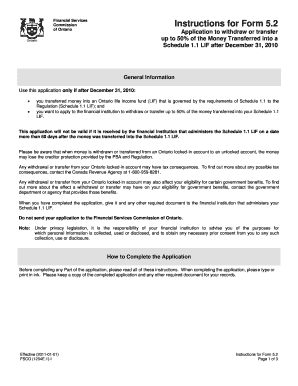

Filling out the Form 5.2 is essential for individuals seeking to withdraw or transfer funds from their Ontario life income fund (LIF). This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Form 5.2 online.

- Press the ‘Get Form’ button to access the Form 5.2. This will allow you to retrieve the fillable online version of the form.

- Provide your personal information in Part 1. This includes your full name, date of birth, mailing address, contact numbers, and email address if applicable.

- Next, fill in details regarding your Schedule 1.1 LIF. Include the name, address of the financial institution, and your policy or account number.

- In Part 2, specify the date when the money was transferred into your Schedule 1.1 LIF and the amount transferred on that date. Gather this information from your financial institution or contract.

- Indicate the amount you wish to withdraw or transfer, ensuring it does not exceed 50% of the transferred amount indicated in question 2. Choose only one box for clarity.

- Decide whether to withdraw all funds or transfer them to an RRSP or RRIF, checking the appropriate box.

- If transferring, provide the RRSP or RRIF details including the name of the institution and corresponding account information.

- Complete Part 3, certifying your application. This should be done in the presence of a witness who will also sign the document.

- If applicable, have your spouse complete Part 4 for consent. A witness must also be present for this section.

- Once all necessary sections are completed and signed, submit the form to the financial institution that administers your Schedule 1.1 LIF. Do not send it to the Financial Services Commission of Ontario.

Begin filling out the Form 5.2 online now to manage your financial benefits effectively.

Absolutely, IRS fillable forms can be filed electronically, but specific requirements may apply. For example, the Form 5 2 Fillable can often be filed online through approved e-filing systems. It's essential to check the IRS guidelines to ensure compliance with electronic filing procedures.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.