Get Pts Deferred Compensation Hawaii

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pts Deferred Compensation Hawaii online

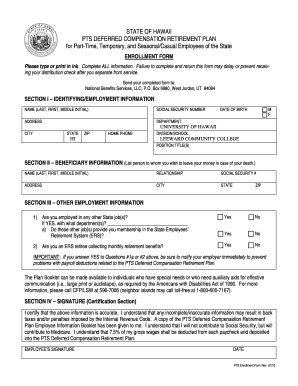

Filling out the Pts Deferred Compensation Hawaii enrollment form is a crucial step for part-time, temporary, and seasonal employees looking to manage their retirement savings effectively. This guide provides clear, detailed instructions to support you in completing the form accurately and efficiently.

Follow the steps to successfully complete your enrollment form.

- Press the ‘Get Form’ button to access the enrollment form. This will allow you to download and open the document for completion.

- Begin by filling out Section I, which contains your identifying and employment information. Provide your full name (last, first, middle initial), social security number, address, date of birth, gender, department, position title, and a contact phone number.

- Proceed to Section II to designate your beneficiary. Enter the name of the person you wish to assign as your beneficiary, their relationship to you, their social security number, and their complete address.

- In Section III, answer the questions regarding other employment. If you are employed in other State jobs or are an ERS retiree, provide the necessary details to ensure proper processing.

- Read the important note regarding potential payroll deduction issues if you have answered 'Yes' to specific questions in Section III. It is vital to notify your employer of such circumstances.

- Finally, move to Section IV and certify that the information you provided is accurate by signing and dating the form. Understand the implications of your commitment and that incomplete information may incur penalties.

- Once you have filled out all sections, ensure to save your changes. You may choose to download, print, or share the completed form as needed before submission.

Complete your Pts Deferred Compensation Hawaii enrollment form online today for a secure retirement future.

PTS Deferred Compensation refers to a strategy where employees defer a portion of their earnings to a future date, usually retirement. This approach helps minimize current taxable income while allowing for potential investment growth. It provides a valuable way to secure your financial future. For detailed plans and options, explore the offerings at US Legal Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.