Get Form 1128

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 1128 online

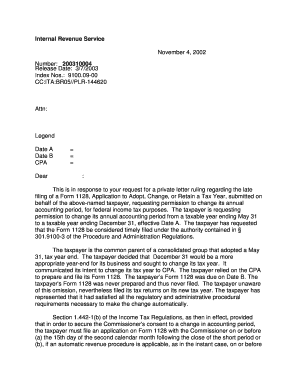

Filling out Form 1128, Application to Adopt, Change, or Retain a Tax Year, is a crucial task for taxpayers seeking to change their accounting period. This guide will walk you through the process of completing the form online, ensuring a smooth and efficient filing experience.

Follow the steps to complete Form 1128 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully read the form instructions to understand the purpose of Form 1128 and the information required for each section.

- Enter the name of the taxpayer in the designated field along with their identifying information, such as the Employer Identification Number (EIN).

- Specify the accounting period you wish to adopt, including the current year-end date and the requested year-end date.

- Provide the reason for the change in accounting period. It's essential to clearly explain why the new tax year is more appropriate for your business.

- Include any additional information or statements that support your request, if applicable.

- Review all entered information for accuracy to avoid delays or issues with processing.

- Once you have completed the form, save your changes. You can then download, print, or share the form as needed.

Start completing your Form 1128 online today to make your tax year changes official!

You can get your tax transcript online by visiting the IRS website and using the Get Transcript tool. Simply create or log in to your account, then follow the prompts to request your tax transcript. This process is straightforward and efficient, allowing you to access your information without delay. If you need assistance, US Legal Forms offers comprehensive support and resources for navigating tax processes.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.