Loading

Get 1092 Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1092 tax form online

Filling out the 1092 Tax Form online can be straightforward if you follow the proper steps. This guide provides clear instructions on how to accurately complete each section of the form, making your filing experience as smooth as possible.

Follow the steps to complete the 1092 Tax Form online.

- Press the ‘Get Form’ button to obtain the 1092 Tax Form and open it in your preferred online editor.

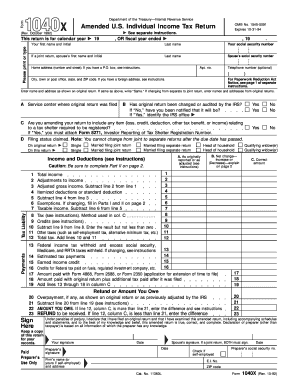

- Begin filling in your personal information. Enter your first name and initial, last name, and social security number in the appropriate fields. If filing a joint return, include your partner’s first name, last name, and social security number.

- Provide your home address, including the street number, apartment number (if applicable), city, state, and ZIP code. If you have a foreign address, follow the specific instructions for foreign addresses.

- Indicate whether your original return has been changed or audited by the IRS by answering the relevant questions regarding your status.

- Choose your filing status for this return. Confirm whether you are married filing jointly, single, married filing separately, or qualifying widow(er). Be cautious not to change from joint to separate filing status after the due date.

- Detail your income and deductions. Fill in the total income, adjustments, adjusted gross income, and either itemized or standard deductions. Follow the instructions provided for each line to report the correct amounts.

- Complete the tax liability section, which includes your total tax, credits, and any additional taxes. Ensure to provide accurate amounts as instructed on the form.

- Review the refund or amount you owe section. Calculate your overpayment, the amount due, or the refund based on your tax liabilities and compared to your previous return.

- Sign the declaration at the end of the form, stating that you have filed an original return and that all information provided is accurate to the best of your knowledge. If applicable, your partner should also sign the return.

- Finally, save your changes. You can download, print, or share the completed form as needed.

Start completing your 1092 Tax Form online today for a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file your 1099 taxes, follow these steps: Gather all necessary income documentation, fill out the appropriate forms, such as the 1092 tax form if applicable, and review for accuracy. Next, ensure you meet filing deadlines. Finally, submit your forms electronically or via mail to the IRS, and keep copies for your records.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.