Loading

Get Calculating Tax On Beer Omb No 1513 0083

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calculating Tax On Beer OMB No 1513 0083 online

Filling out the Calculating Tax On Beer OMB No 1513 0083 form online can be straightforward with clear instructions. This guide will walk you through each step of the process, ensuring you complete your tax return accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click ‘Get Form’ button to access the form, enabling you to open it in your preferred editor.

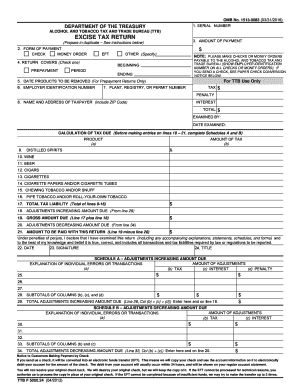

- Enter your serial number in the first section to identify your submission.

- Indicate your form of payment by selecting either check, money order, or electronic funds transfer (EFT) in section 2.

- In section 4, specify whether your return covers prepayment or other tax requirements. Ensure you clearly identify the tax period by filling in the beginning and ending period dates.

- If applicable, fill out section 5 with the date products will be removed for prepayment returns.

- Enter your employer identification number in section 6, ensuring it is correct for payment tracking.

- Provide your plant, registry, or permit number in section 7 if you have one.

- Complete the name and address of the taxpayer in section 8, including your ZIP code for mailing purposes.

- In the Calculation of Tax Due section, accurately enter the amounts for different product categories from lines 9 to 16 based on your sales and removals during the tax period.

- Calculate the total tax liability on line 17 by summing the amounts from the previous lines.

- Document any adjustments increasing the amount due in Schedule A, if applicable. Follow the instructions to detail errors or transactions that affect the tax owed.

- Use Schedule B to report any adjustments decreasing the amount due, providing necessary explanations as instructed.

- Finalize the form by declaring the accuracy of the information provided in section 21, and adding your signature, date, and title in sections 23, 22, and 24, respectively.

- After completing the form thoroughly, you can save changes, download, or print a copy, and prepare it for submission.

Start completing your documents online today to ensure timely and accurate submissions.

To compute the excise tax, you start by determining the specific category of the alcohol product and the state laws applicable. By identifying the volume sold, you multiply it by the relevant tax rate. For industry operators, mastering Calculating Tax On Beer Omb No 1513 0083 can streamline this process and ensure accurate tax computation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.