Loading

Get Ftb 3805p 2006 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 3805p 2006 form online

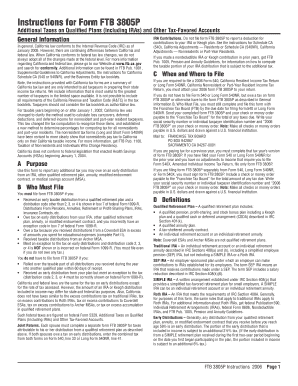

Filling out the Ftb 3805p 2006 form online can be a straightforward process when guided through the necessary steps. This guide provides clear, step-by-step instructions to help individuals accurately complete the form and ensure compliance with California tax regulations.

Follow the steps to complete the Ftb 3805p 2006 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Review the form sections and understand its purpose. The Ftb 3805p 2006 form is used to report any additional tax owed on early distributions from qualified retirement accounts.

- In Part I, list any early distributions that were included in your income. Make sure to enter the total amount received from qualified retirement plans before reaching the age of 59½.

- On line 2 of Part I, indicate any early distributions that are not subject to additional tax by referring to the exception codes provided in the instructions.

- Calculate the amount subject to tax by subtracting the non-taxable amounts from the total distributions listed in line 1 and enter the result on line 4.

- If applicable, complete Part II for any additional tax concerning distributions from Coverdell ESAs or QTP not used for educational expenses.

- Review all entries carefully to ensure accuracy and completeness. Save the form as you make changes.

- Once completed, users can save their changes, download the form, print it, or share it as needed according to their filing requirements.

Complete your documents online to ensure accurate filing and compliance with tax regulations.

You can order California tax forms online through the California Franchise Tax Board website, where you can find all necessary documents, including the Ftb 3805p 2006 Form. Additionally, forms are available at local libraries or post offices. If you prefer a more streamlined process, consider using platforms like USLegalForms, which can simplify ordering tax documents for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.