Loading

Get 1996 Form 1040 (schedule Se)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1996 Form 1040 (Schedule SE) online

Filling out the 1996 Form 1040 (Schedule SE) online can seem daunting, but with clear instructions, it is manageable. This guide will walk you through the essential steps to complete the form accurately and efficiently.

Follow the steps to complete your 1996 Form 1040 (Schedule SE) online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Enter your name and social security number as they appear on Form 1040 in the designated fields.

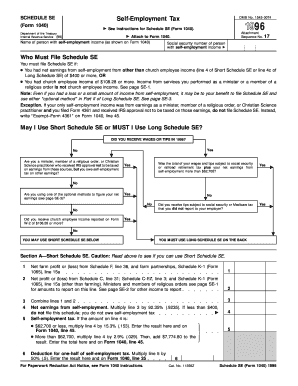

- Determine if you must file Schedule SE. If you had net earnings from self-employment of $400 or more, or church employee income of $108.28 or more, you must file.

- Select whether to use the Short Schedule SE or Long Schedule SE based on your earnings. Review the provided questions and criteria thoroughly.

- For the Short Schedule SE, report your net farm profit or loss on line 1 and net profit or loss from your business on line 2. Combine these figures on line 3.

- Multiply the total from line 3 by 92.35% to find your net earnings from self-employment. If this amount is less than $400, you do not need to file this schedule.

- Calculate your self-employment tax by applying the correct percentage based on your earnings. Use line 5 for amounts $62,700 or less, and adjust for amounts over this threshold.

- Record your deduction for one-half of the self-employment tax on line 6 to reduce your taxable income.

- If you must use the Long Schedule SE, follow similar steps but complete more detailed calculations for your income sources and tax liabilities.

- Once all entries are made, review your information for accuracy. You can then save your changes, download, print, or share your completed form as necessary.

Begin completing your 1996 Form 1040 (Schedule SE) online now.

Yes, there is a worksheet for Form 1040 ES that helps you calculate your estimated tax payments. This worksheet is beneficial for taxpayers who expect to owe tax, as it outlines how to determine your estimated tax amounts. Completing this worksheet can assist you in managing your tax responsibilities effectively. For more resources, consider the services provided by uslegalforms to navigate your tax needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.