Loading

Get Payee Data Record For Interest (in Lieu Of Irs W-9)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PAYEE DATA RECORD FOR INTEREST (in Lieu Of IRS W-9) online

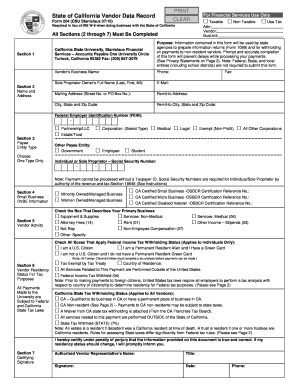

The PAYEE DATA RECORD FOR INTEREST is a crucial form required when doing business with the State of California. This guide offers clear and comprehensive instructions on how to accurately complete this form online.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the 'Attn', 'Vendor', and 'BusUnit' fields with the relevant information for your records.

- Enter your phone number and the full name of the sole proprietor (if applicable), including the last name, first name, and middle initial.

- Provide your email address and your mailing address, including street number or PO Box, city, state, and ZIP code. Ensure accuracy for future correspondence.

- In Section 2, enter the vendor's business name and complete the remit-to address if it differs from your mailing address.

- For Section 3, select your payee entity type by checking the appropriate box. Only one box should be selected.

- In Section 4, indicate if your business is minority-owned, women-owned, or a certified small business by checking the corresponding boxes.

- Section 5 requires you to specify your vendor activity by checking all applicable boxes related to your services or products.

- In Section 6, indicate your residency status for tax purposes by checking the applicable options based on your citizenship and whether you're a resident or non-resident of California.

- Finally, in Section 7, provide the name and title of the individual certifying the form, their signature, and the date completed. Make sure to include a phone number for further contact.

- After completing the form, review all entries for accuracy. You can then save your changes, download a copy, print the form, or share it as required.

Start completing your PAYEE DATA RECORD FOR INTEREST online today.

The payee on a W-9 form is the individual or entity that receives income and is required to report it to the IRS. This could be a freelancer, contractor, or any business that is providing services for payment. By utilizing the PAYEE DATA RECORD FOR INTEREST (in Lieu Of IRS W-9), you can easily identify the correct payee details needed for accurate reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.