Loading

Get Com103 Alabama Department Of Revenue Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Com103 Alabama Department Of Revenue Form online

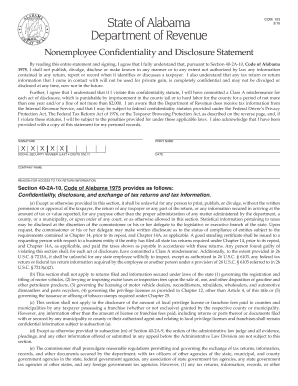

The Com103 Alabama Department Of Revenue Form is essential for individuals seeking access to tax return information while ensuring confidentiality. This guide will walk you through the process of filling out this form online, step by step, to help you navigate each section effectively.

Follow the steps to complete the Com103 form online with ease.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by reading the confidentiality statement thoroughly. This section outlines your obligations regarding the disclosure of taxpayer information and the penalties for violations. Ensure that you understand these requirements before proceeding.

- Provide your signature in the designated area. This signifies that you agree to comply with the confidentiality terms laid out in the form.

- Print your name clearly beneath your signature to ensure proper documentation.

- Enter the last four digits of your Social Security number in the specified field. This information is necessary for identification purposes.

- Fill in the date when you are completing the form in the provided section.

- Indicate your company name if applicable. This is required for individuals representing an organization.

- Lastly, provide a brief explanation of your reason for accessing the tax return information. This helps justify your request and provides necessary context.

- Once all fields are completed, review your form to ensure all information is accurate. After checking, you can save changes, download, print, or share the form as needed.

You are now ready to complete the Com103 form online. Start the process today!

Alabama requires employers to withhold state income tax from employee wages, following guidelines set by the Alabama Department of Revenue. This includes registering with the department and using the correct withholding rates. For detailed instructions, look into how the Com103 Alabama Department Of Revenue Form fits into your compliance strategy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.