Get Form 990 - Moving From The Old To The New - Internal Revenue ... - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 990 - Moving From The Old To The New - Internal Revenue ... - IRS online

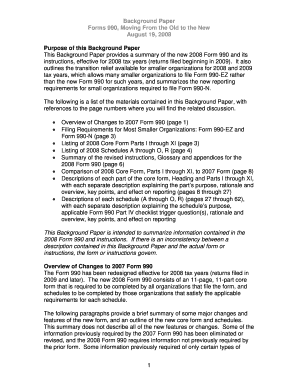

Filing Form 990, the annual information return for tax-exempt organizations, can be a complex process. This guide aims to provide a clear and user-friendly approach to navigating the new Form 990, focusing on its various sections and requirements for efficient online completion.

Follow the steps to fill out the Form 990 online effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin with Part I, Summary, which requires an overview of the organization’s mission, significant activities, and key financial data from the current and previous year.

- Complete Part II, Signature Block, ensuring the authorized officer’s signature is provided.

- In Part III, provide a Statement of Program Service Accomplishments detailing the organization’s program services and achievements.

- Move to Part IV, the Checklist of Required Schedules, to determine which additional schedules need to be completed based on your organization’s activities.

- Continue to Part V to report Statements Regarding Other IRS Filings and Tax Compliance, indicating compliance with other reporting requirements.

- Fill out Part VI, Governance, Management, and Disclosure, which covers questions about the organization’s governance policies and practices.

- Complete Part VII, which focuses on Compensation of Officers, Directors, Key Employees, and others, ensuring accurate reporting of compensation.

- Proceed to Parts VIII, IX, and X to provide detailed financial statements, including revenue and expenses.

- In Part XI, report on financial statements and accounting methods used by the organization.

- Finally, review all sections for completeness, save changes, and download or print the form for your records.

Begin the process of completing your Form 990 online to comply with IRS regulations.

IRS Form 4549 is used by the IRS to propose adjustments to your tax return after an audit. This form outlines specific changes to your previously filed tax returns and the potential tax liability associated with those adjustments. Utilizing accurate forms and maintaining clear lines of communication with the IRS, especially when addressing issues relevant to Form 990 - Moving From The Old To The New - Internal Revenue ... - IRS, is crucial for effective resolution.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.