Loading

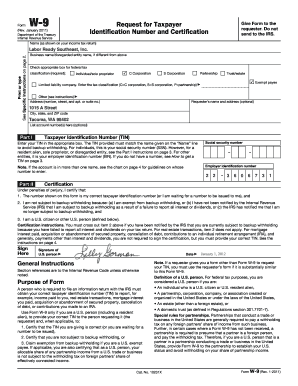

Get People Ready Ein

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the People Ready Ein online

Filling out the People Ready Ein form online is a straightforward process that requires attention to detail. This guide will help you navigate through each section to ensure that your submission is accurate and complete.

Follow the steps to fill out the People Ready Ein online successfully:

- Press the ‘Get Form’ button to access the form and open it in your digital editor.

- Begin by entering your name as it appears on your income tax return in the designated 'Name' field. Ensure that your name is accurate to prevent complications.

- If applicable, provide your business name on the line labeled 'Business name/disregarded entity name'. This is particularly important if you are operating under a different name.

- Select the appropriate box for your federal tax classification. Choose from the options provided, which include individual/sole proprietor, C corporation, S corporation, partnership, trust/estate, or limited liability company (LLC). If selecting LLC, enter your tax classification code.

- Fill in your address information, including the number, street, apartment, or suite number, along with the city, state, and ZIP code.

- In 'Part I', enter your Taxpayer Identification Number (TIN). For individuals, this is typically your social security number (SSN), while other entities should use their employer identification number (EIN).

- Sign the form in the 'Certification' section, confirming that the information provided is accurate and that you meet the requirements stated.

- Finally, review all the information for accuracy and completeness. Once satisfied, you can save changes, download, print, or share the completed form as necessary.

Start filling out your documents online now to ensure a smooth and efficient process.

To look up the EIN number for a business, you can use the IRS website, search public databases, or financial documents. Additionally, utilizing People Ready EIN resources can simplify your search by quickly directing you to the appropriate documents and filings where the EIN may be recorded.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.