Loading

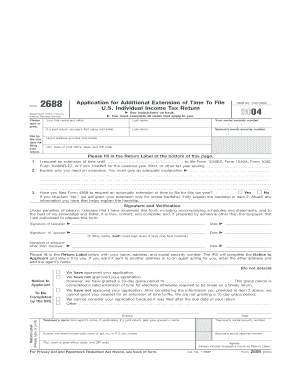

Get Form 2688. Application For Additional Extension Of Time To File U.s. Individual Income Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2688. Application For Additional Extension Of Time To File U.S. Individual Income Tax Return online

Filling out Form 2688 allows you to request an additional extension of time to file your U.S. individual income tax return. This guide provides clear and comprehensive instructions on each section of the form to assist you in completing it accurately and efficiently.

Follow the steps to complete the form correctly:

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Complete your personal information in the top section. Provide your last name, first name, and middle initial if applicable. Include your social security number. If you are filing jointly, include your spouse's first name and social security number.

- Fill out your home address, including the number and street, city or town, state, and ZIP code.

- In the next section, indicate the tax year for which you are requesting an extension by specifying the date until which you seek additional time to file.

- In line 2, provide a detailed explanation of why you are requesting more time. Ensure your explanation is thorough, as vague reasons may lead to denial of your request.

- Answer whether you have filed Form 4868 to request an automatic extension. If you have not, be prepared to explain your hardship clearly.

- Sign and date the form. If filing jointly, both taxpayers must sign. Include a signature from the preparer if someone else is preparing the form.

- Complete the Return Label with your name, address, and social security number for IRS correspondence. This is crucial for receiving the Notice to Applicant.

- Double-check all entered information for accuracy before finalizing your form.

- Once completed, save your changes. You can choose to download, print, or share the form as needed.

Complete your Form 2688 online today to ensure your tax filing is timely and organized.

Related links form

Yes, you can request a second extension to file your taxes by submitting Form 2688, Application For Additional Extension Of Time To File U.S. Individual Income Tax Return. This form allows you to obtain additional time beyond your initial extension. It’s essential to act promptly to avoid any late filing penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.