Get Tax Transcript Codes

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Transcript Codes online

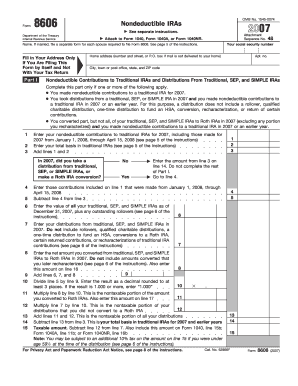

This guide provides clear and detailed instructions on how to complete the Tax Transcript Codes form online. It aims to assist users in accurately filling out the necessary sections to ensure compliance and efficiency.

Follow the steps to effectively fill out your Tax Transcript Codes form.

- Click the ‘Get Form’ button to obtain the Tax Transcript Codes form and open it for editing.

- Begin by entering your name in the designated field. If you are submitting the form for a married couple, each spouse must complete a separate form.

- Fill in your social security number accurately to ensure proper identification.

- In the home address section, provide your full address. If filing this form alone and not with a tax return, include only your address.

- Move to Part I. Record any nondeductible contributions made to traditional IRAs for the specified year. Be sure to include contributions made up to the mid-April deadline of the following year.

- Next, indicate your total basis in traditional IRAs. This will help in calculating any distributions or conversions made.

- If you took a distribution from any IRAs in the specified year, indicate yes or no accordingly.

- If yes, enter relevant amounts received from these distributions. This includes traditional, SEP, and SIMPLE IRAs while excluding certain types of transactions.

- Complete any subsequent calculations based on previous entries, ensuring each line reflects accurate information as per IRS instructions.

- Once all sections are complete, review for accuracy. You can then save your changes, download the form for your records, print it, or share it with your tax professional.

Begin filling out your Tax Transcript Codes form online now to stay ahead of your tax responsibilities.

To decode tax transcript codes, start by obtaining a copy of your IRS transcript, which provides a comprehensive list of these codes. You can then reference the IRS guidelines or consult tax resources that explain each code in detail. If necessary, platforms like US Legal Forms can assist you in navigating the complexities of tax transcript codes. This ensures that you fully understand your tax records and take appropriate action if needed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.