Loading

Get Picture Of Taxpayer Informatio

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Picture Of Taxpayer Information online

This guide provides clear and comprehensive instructions on filling out the Picture Of Taxpayer Information form online. Designed for users with varying levels of experience, this resource will help you navigate each section with confidence.

Follow the steps to complete the form online.

- Press the ‘Get Form’ button to access the form and open it for your use.

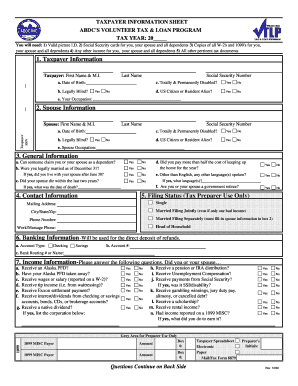

- Begin by entering your last name, first name, and middle initial in the taxpayer information section. Ensure that the information matches your official records.

- Input your Social Security Number (SSN) accurately in the designated field.

- Provide your date of birth by selecting the corresponding date from the date picker or entering it manually.

- Indicate whether you are totally and permanently disabled or legally blind by selecting 'Yes' or 'No' for each question.

- Specify if you are a U.S. citizen or resident alien by selecting the appropriate option.

- Fill in your occupation in the allocated field and repeat the process for your spouse by completing the spouse information section.

- In the general information section, answer questions about dependents, living situation, and language spoken, ticking 'Yes' or 'No' as appropriate.

- Provide your contact information including mailing address, city, state, zip code, and phone numbers.

- Complete the banking information section, specifying the account type, account number, and bank routing details for direct deposits.

- Answer the income information questions by indicating 'Yes' or 'No' for various income sources relevant to you and your spouse.

- List any dependents and provide required details such as birth date, Social Security number, and relationship in the household composition section.

- Answer questions regarding your business operations and expenses during the tax year.

- Complete the taxpayer authorization section by signing and dating the form to verify the accuracy of your provided information.

- Finally, save your changes, and choose from the options to download, print, or share the form as necessary.

Complete your Taxpayer Information form online today for a smoother filing process.

To download your tax information from the IRS, navigate to your online account and access the 'Download Your Tax Records' feature. This section allows you to retrieve necessary documents quickly and securely. Also, uslegalforms can assist you by providing the right forms to ensure you capture all required taxpayer information during this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.