Loading

Get Sd Eform 1932

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sd Eform 1932 online

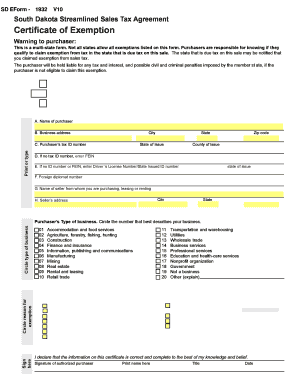

The Sd Eform 1932 is an essential document for individuals and businesses seeking to claim exemption from sales tax in South Dakota. Completing this form online can streamline the process and ensure accuracy, making it easier for users to navigate through the required information.

Follow the steps to complete the Sd Eform 1932 effectively.

- Click ‘Get Form’ button to access the form and open it in the editor.

- Begin by indicating if you are attaching the Multistate Supplemental form. If not, provide the two-letter abbreviation for the state under which you are claiming exemption.

- Next, identify if this is a Single Purchase Certificate by checking the appropriate box and entering the invoice or purchase order number.

- Fill in the section titled ‘Name of purchaser’ with the legal name of the person or entity making the purchase. Also, provide the business address including city, state of issue, and zip code.

- Enter the purchaser’s tax ID number or, if unavailable, the Federal Employer Identification Number (FEIN). If neither is applicable, provide the driver's license number or state-issued ID number.

- Record the foreign diplomat number, if relevant, and the name and address of the seller from whom you are making the purchase, leasing, or renting.

- Circle the type of business that best describes your operations from the provided options. This includes categories ranging from accommodation services to government.

- Indicate the reason for exemption by circling the letter corresponding to the justification for your claim. This section includes various options such as agricultural, federal government, or charitable organization.

- Finally, sign and date the form where indicated, including your printed name and title to certify that all information provided is accurate to the best of your knowledge.

Complete your Sd Eform 1932 online today for a seamless filing experience.

In Utah, becoming tax exempt usually involves filling out the correct forms and proving eligibility. You can find these forms on the Utah State Tax Commission website. To streamline this process, consider using SD Eform 1932 from USLegalForms, which guides you through the necessary steps for a smooth application.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.