Get Form 954

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 954 online

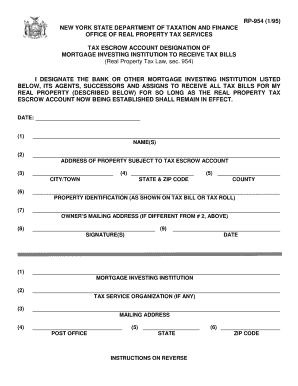

Filling out Form 954 is an essential step for designating a mortgage investing institution to receive tax bills related to your real property. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a seamless process for users of all backgrounds.

Follow the steps to fill out Form 954 online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- In the first section, provide the name of the bank or mortgage investing institution you are designating to receive the tax bills. Ensure that you enter this information clearly and accurately.

- Next, enter the address of the property that is subject to the tax escrow account. This should include the street address and any relevant details that precisely identify the location.

- Fill in the city or town where the property is located. This information is crucial for correctly processing the tax documents.

- Input the property identification number as shown on your tax bill or tax roll. This number helps in identifying your property uniquely within the tax system.

- If the mailing address of the property owner differs from the property's address, provide the owner's mailing address in this section.

- Sign the form in the designated signature field. Make sure the signature is illegible, printed, or typewritten.

- Enter the name of the mortgage investing institution once more in this section for verification purposes.

- If applicable, list the tax service organization associated with your mortgage investing institution.

- Complete the mailing address of the tax service organization, including the post office and county.

- Finally, review all entered information to ensure accuracy. Once satisfied, you can save changes, download, print, or share the completed form as needed.

Complete your documents online today to streamline your mortgage tax processes.

The IRS $100,000 next day deposit rule requires businesses to deposit any tax liability exceeding $100,000 by the next business day. This rule is crucial for ensuring timely compliance with federal tax obligations to avoid penalties. If you have questions about deposit requirements or need help with Form 954, utilizing US Legal Forms can provide clear instructions and resources tailored for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.