Get Easypath Escrow Account Requirements

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EasyPath Escrow Account Requirements online

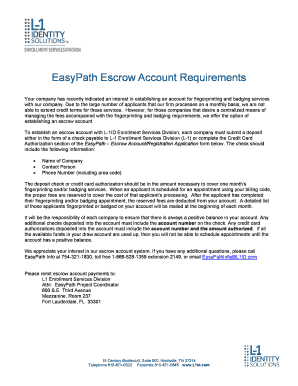

Filling out the EasyPath Escrow Account Requirements form is an essential step for companies wishing to establish an escrow account for fingerprinting and badging services. This guide provides clear, step-by-step instructions to ensure a smooth and efficient filling process.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the EasyPath Escrow Account Requirements form and open it in your preferred editor.

- Begin filling in the company information section. Input the company name, address, city, state, and ZIP code. Ensure all details are accurate and complete.

- Provide the contact person's name, fax number, telephone number, and email address. This information is crucial for communication regarding the escrow account.

- In the method of payment section, indicate whether you are paying by check or credit card. If paying by check, provide the check number. If using a credit card, fill out the necessary credit card information below.

- Specify the deposit amount for the account, indicating the amount to be charged for prepaid accounts.

- Complete the credit card authorization section if you are paying by credit card. Fill in the name on the credit card, type of card (Visa or Mastercard), credit card number, expiration date, and CSV code.

- Sign and print your name in the authorization section to allow L-1 Enrollment Services to charge your credit card for the specified amount.

- Finally, include your name and signature in the 'Form completed by' section along with the date.

- After filling out the form, you can save your changes, download, print, or share the completed form as needed.

Complete your EasyPath forms online today for a seamless escrow account setup.

Related links form

Mortgage escrow accounts are primarily regulated by federal laws, including RESPA, and state regulations may also apply. Understanding the EasyPath Escrow Account Requirements will help you navigate this regulatory landscape effectively. In addition, bank regulations may impose further guidelines on how these accounts should operate. Knowing who regulates these accounts can empower you to ensure compliance and security.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.