Get Employee Directed Salary Deferral 401k Plan Enrollment Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Directed Salary Deferral 401k Plan Enrollment Form online

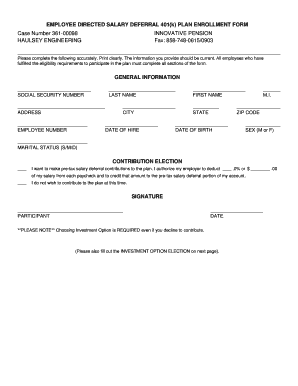

Filling out the Employee Directed Salary Deferral 401k Plan Enrollment Form online is a crucial step for employees who wish to participate in the retirement savings plan. This guide provides step-by-step instructions to ensure that you complete the form accurately and effectively.

Follow the steps to successfully complete the form online.

- Click 'Get Form' button to obtain the form and open it in the online editor.

- In the general information section, provide your social security number, address, last name, first name, middle initial, employee number, date of hire, date of birth, sex, marital status, and zip code. Make sure all information is current and clearly printed.

- For the contribution election, indicate whether you want to make pre-tax salary deferral contributions to the plan. Specify the percentage or amount you would like to contribute from each paycheck. If you choose not to contribute, check the appropriate box.

- Sign and date the form as a participant. Ensure that your signature matches the name you provided and represents your agreement to the terms.

- In the investment option election section, select your desired investment allocations. Remember that all allocations must be made in whole percentages. Consult the risk category legend to aid your selection.

- Confirm that all sections have been completed accurately. Review your entire form for any errors or omissions.

- Once satisfied with your completed form, save your changes, and proceed to download, print, or share the form as required.

Start completing your Employee Directed Salary Deferral 401k Plan Enrollment Form online today!

A 6% employee deferral refers to the portion of your salary that you choose to contribute to your Employee Directed Salary Deferral 401k Plan. This means if your salary is $50,000, you will allocate $3,000 to your 401k plan each year. By setting this percentage, you can save for retirement while potentially enjoying tax benefits. It's a smart way to grow your savings over time.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.