Loading

Get 0106 0040 01 R03 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 0106 0040 01 R03 Form online

Filling out the 0106 0040 01 R03 Form online may seem daunting, but with the right guidance, you can complete it easily and accurately. This guide provides step-by-step instructions to help you navigate through each section of the form effectively.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in your selected editor.

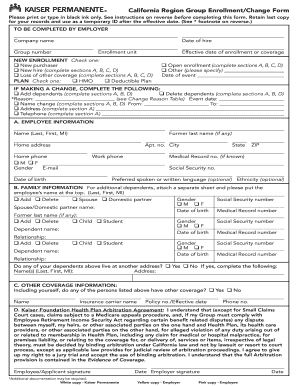

- Begin by completing the section labeled ‘To be completed by employer.’ Here, the employer must enter the company name, date of hire, group number, enrollment unit, and effective date of enrollment or coverage.

- For new enrollments, indicate whether the submission is for a new purchaser, new hire, loss of other coverage, or open enrollment. Be sure to provide the date of the relevant event.

- If this is a change request, specify if you are adding or deleting dependents, altering your name, address, or telephone number. Fill out the necessary sections (A, B, D) accordingly.

- In Section A, provide detailed employee information, including your name, former last name (if any), home address, phone numbers, gender, email address, social security number, and date of birth.

- In Section B, you can add or delete dependents. Provide their names, social security numbers, dates of birth, and indicate if they are students or children.

- In Section C, answer whether anyone listed has other coverage, and provide the necessary details if applicable.

- In Section D, review the Kaiser Foundation Health Plan Arbitration Agreement. Ensure you understand the terms, and provide your signature along with the date.

- After completing all necessary sections, double-check your information for accuracy. Save your changes and download or print the completed form.

- Finally, retain the last copy of the form for your records and use it as a temporary ID after the effective date.

Complete your documents online today to ensure a smooth enrollment process.

There is technically no minimum income requirement to file a Schedule C, but if your gross income exceeds $400, you must report it. If you earn less than this amount, it may not be mandatory to file. However, filing can still yield benefits, such as claiming eligible deductions. To ensure you meet compliance when using the 0106 0040 01 R03 Form, consult relevant tax guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.