Get Sba Loan Programs Chart

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sba Loan Programs Chart online

Completing the Sba Loan Programs Chart online is an essential step in managing your loan applications effectively. This guide provides clear, step-by-step instructions on how to navigate through the various sections and fields of the form, ensuring a smooth experience for all users.

Follow the steps to successfully complete the form

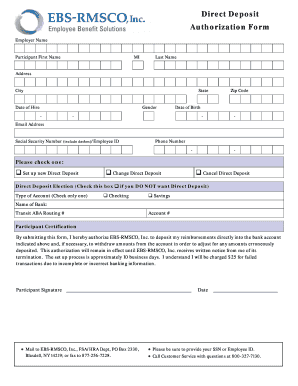

- Press the ‘Get Form’ button to access the form, which will open in your browser for online completion.

- Begin by entering your employer's name in the designated field to identify the organization associated with the loan application.

- In the participant section, fill in your first name, middle initial (MI), and last name to clearly identify your application.

- Provide your address, city, state, and zip code to ensure accurate contact and location details.

- Input your date of hire and date of birth in the respective fields to verify your employment duration and personal information.

- Select your gender from the provided options, ensuring it aligns with the information requested by the loan program.

- Enter your email address and phone number to facilitate communication regarding your application status.

- Choose the appropriate option indicating whether you want to set up, change, or cancel your Direct Deposit by selecting the relevant checkbox.

- Indicate your preference for Direct Deposit by checking the box if you do not wish to participate in this option.

- Select the type of account (checking or savings) that you wish to link for Direct Deposit.

- Provide the name of your bank and enter the transit ABA routing number as well as your account number for deposit accuracy.

- Read and acknowledge the participant certification section, indicating your authorization for transactions related to your deposit.

- Sign and date the form to confirm that all information provided is accurate and complete.

- Submit the completed form by mailing it to EBS-RMSCO, Inc. at the specified address or by faxing it to the provided number.

- Ensure you save changes, download a copy for your records, or share the completed form as required.

Complete your Sba Loan Programs Chart online today to streamline your loan application process.

The SBA offers several types of loans to cater to various business needs. Major types include the 7(a) loan, which is one of the most flexible options, and the CDC/504 loan, ideal for real estate and equipment purchases. Additionally, the Microloan Program provides smaller loan amounts for startups and small enterprises. For a detailed comparison of these options, refer to the Sba Loan Programs Chart, which helps you understand each program's features and benefits.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.