Loading

Get 2119 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2119 Form online

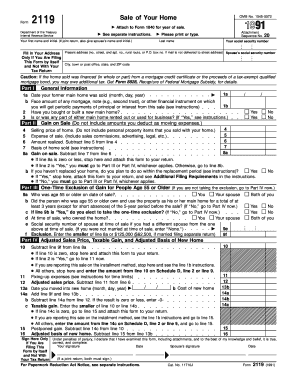

The 2119 Form, known as the Sale of Your Home form, is an important document for tax reporting related to the sale of your main home. This guide provides step-by-step instructions to help you complete the form efficiently and accurately online.

Follow the steps to successfully complete the 2119 Form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your first name and initial in the designated field. If filing jointly, include your spouse's name and initial as well.

- Fill in your last name and social security number. For those filing separately, enter your spouse's social security number in the specified field.

- Provide your current address, including the street, apartment number (if applicable), city, state, and ZIP code.

- In Part I, indicate the date your former main home was sold, and specify any outstanding mortgage or financial instruments tied to the sale.

- Answer the questions in Part I regarding the purchase of a new home and whether any part of your main home was rented or used for business purposes.

- Move to Part II to report the details of the sale. Input the selling price of the home and any associated expenses, taking care not to include personal items sold with the home.

- Calculate the amount realized by subtracting the expenses of the sale from the selling price. Enter this figure in the appropriate field.

- Determine the basis of the home sold and enter that value. Calculate the gain on the sale by subtracting the basis from the amount realized.

- If applicable, complete Part III regarding the one-time exclusion for individuals aged 55 or older. Answer the questions regarding home ownership and usage.

- In Part IV, you'll need to evaluate any postponed gain and the adjusted basis of a new home, following the instruction prompts carefully.

- After completing all relevant sections, review your entries for accuracy before proceeding to save changes, download, or print the form.

Don't wait — complete your tax documentation online today.

Yes, you can eFile your 2019 tax return in 2024, but you must use approved software or services that support prior year filings. Be sure to include necessary forms like the 2119 Form if they apply to your tax situation. Platforms such as US Legal Forms can guide you through eFiling for previous years, helping you avoid potential errors.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.