Get 1996 Form 4868 - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

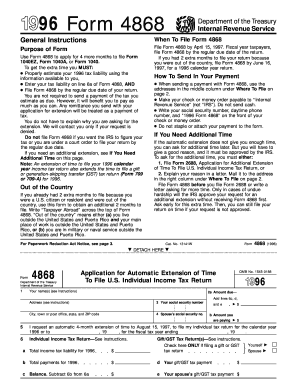

Tips on how to fill out, edit and sign 1996 Form 4868 - IRS - Irs online

How to fill out and sign 1996 Form 4868 - IRS - Irs online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Business, tax, legal and other e-documents require a high level of protection and compliance with the legislation. Our templates are regularly updated in accordance with the latest legislative changes. Plus, with our service, all of the information you include in the 1996 Form 4868 - IRS - Irs is well-protected against loss or damage by means of industry-leading encryption.

The tips below will allow you to fill out 1996 Form 4868 - IRS - Irs easily and quickly:

- Open the form in our feature-rich online editing tool by clicking on Get form.

- Fill in the necessary boxes that are yellow-colored.

- Click the green arrow with the inscription Next to jump from one field to another.

- Use the e-signature tool to put an electronic signature on the template.

- Insert the date.

- Check the whole e-document to make sure you have not skipped anything.

- Hit Done and download the new template.

Our solution allows you to take the whole process of completing legal documents online. As a result, you save hours (if not days or weeks) and get rid of additional expenses. From now on, complete 1996 Form 4868 - IRS - Irs from the comfort of your home, place of work, as well as on the move.

How to edit 1996 Form 4868 - IRS - Irs: customize forms online

Pick a reliable document editing solution you can rely on. Edit, complete, and certify 1996 Form 4868 - IRS - Irs safely online.

Too often, editing forms, like 1996 Form 4868 - IRS - Irs, can be a challenge, especially if you got them in a digital format but don’t have access to specialized tools. Of course, you can use some workarounds to get around it, but you risk getting a document that won't meet the submission requirements. Utilizing a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We offer a smoother and more efficient way of modifying files. A comprehensive catalog of document templates that are easy to edit and certify, to make fillable for other individuals. Our platform extends way beyond a collection of templates. One of the best aspects of utilizing our services is that you can edit 1996 Form 4868 - IRS - Irs directly on our website.

Since it's an online-based solution, it spares you from having to get any application. Additionally, not all company policies permit you to download it on your corporate computer. Here's how you can effortlessly and safely complete your documents with our platform.

- Hit the Get Form > you’ll be instantly redirected to our editor.

- Once opened, you can kick off the customization process.

- Select checkmark or circle, line, arrow and cross and other options to annotate your document.

- Pick the date option to add a particular date to your template.

- Add text boxes, graphics and notes and more to enrich the content.

- Utilize the fillable fields option on the right to create fillable {fields.

- Select Sign from the top toolbar to create and create your legally-binding signature.

- Hit DONE and save, print, and share or get the end {file.

Forget about paper and other inefficient methods for completing your 1996 Form 4868 - IRS - Irs or other documents. Use our tool instead that includes one of the richest libraries of ready-to-edit forms and a robust document editing services. It's easy and safe, and can save you lots of time! Don’t take our word for it, give it a try yourself!

To confirm receipt, it's easiest if you use software like TurboTax Easy Extension, since you'll get a confirmation from TurboTax within 48 hours. If you use the U.S. mail to send your extension, you'll have to contact the Internal Revenue Service (IRS) to ask about extension status.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.