Loading

Get Ma Form Sft 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ma Form Sft 3 online

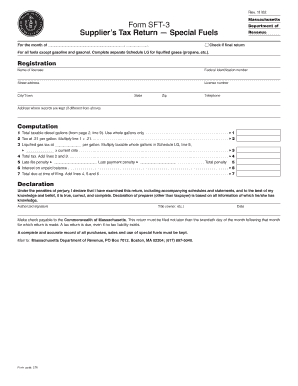

Filling out the Ma Form Sft 3 online is a necessary step for suppliers of special fuels in Massachusetts. This guide provides clear instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Ma Form Sft 3 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the registration section with your full name, federal identification number, address, license number, city/town, state, zip, and telephone number. Additionally, if the address where records are kept differs from your primary address, provide that information as well.

- In the computation section, begin by entering the total taxable diesel gallons in line 1 using only whole gallons. Proceed by multiplying this figure by .21 for tax calculation in line 2.

- For any liquified gas tax, enter the taxable whole gallons from the separate Schedule LG in line 3 and multiply by the current rate. Add lines 2 and 3 in line 4 to calculate your total tax.

- Address any penalties in line 5. Enter the late file penalty and the late payment penalty as applicable. Compute the total penalties and include the interest on any unpaid balance in line 6.

- Finally, add lines 4, 5, and 6 to calculate the total due at filing in line 7.

- In the declaration section, sign where indicated, include your title, and date the form. Remember to retain copies for your records and submit before the due date.

- After review, save your changes, download the completed form, print it if necessary, or share it online according to your needs.

Complete your Ma Form Sft 3 online now to ensure timely submission!

The new law regarding the Massachusetts estate tax has adjusted the inheritance thresholds, which can affect many families. Now, estates valued over a certain amount may be subject to tax, regardless of the decedent’s residency. To navigate this recently revised landscape, you might consider using MA Form Sft 3 on our platform to ensure accurate reporting and compliance with the latest regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.