Loading

Get Scdhec Tire Manifest Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Scdhec Tire Manifest Form online

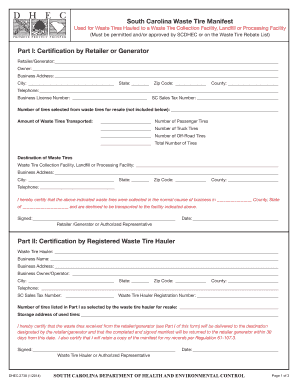

The Scdhec Tire Manifest Form is essential for tracking the transportation of waste tires to approved facilities in South Carolina. This guide will provide clear steps to help users accurately complete the form online, ensuring compliance with state regulations.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor.

- In Part I, certification by retailer or generator, fill in your name, business owner, and address. Provide a business phone number, county, and necessary business license details. Indicate the number of waste tires to be transported, categorized by type — passenger, truck, or off-road — and state the total number of tires.

- Provide the name and address of the destination facility for the waste tires. Complete the certificate section by entering the county and state, and sign and date the form.

- Move to Part II to certify the waste tire hauler's information. Specify the hauler's business details, including the waste tire hauler registration number. Indicate the number of tires selected for resale and their storage address.

- For Part III, the waste tire collection facility must enter its information, including permit status and details about the amount of waste tires received.

- After filling out all parts, ensure you review the information for accuracy. Save your changes, then download, print, or share the completed form as needed.

Complete your Scdhec Tire Manifest Form online to ensure compliance and efficiency in managing waste tires.

You should never throw away worn out tires in regular trash. Instead, take them to a recycling center or a tire shop that manages tire disposal. Proper disposal is crucial, so complete the Scdhec Tire Manifest Form to document your actions responsibly. This form ensures you follow local laws and promotes sustainable waste management.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.