Get Form 1630 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1630 2017 online

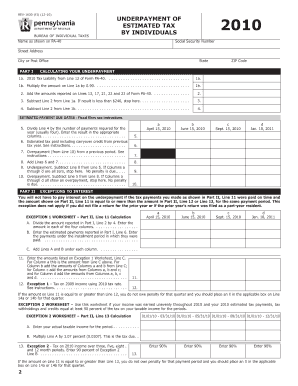

Filling out Form 1630 is an essential step for individuals who need to report underpayment of estimated tax under Pennsylvania personal income tax law. This guide provides you with a comprehensive, step-by-step approach to assist you in completing the form online with ease.

Follow the steps to complete Form 1630 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering your name exactly as it appears on your PA-40 form along with your Social Security Number, address, and ZIP code.

- In Part I, calculate your underpayment by filling in Line 1a with your 2010 tax liability from Line 12 of your PA-40 return.

- Calculate Line 1b by multiplying Line 1a by 0.90 to determine the total tax due.

- For Line 2, sum the credits reported on Lines 13, 17, 21, 22, and 23 of your PA-40 form. If this total is more than Line 1b, you do not owe a penalty and may stop here.

- Proceed to Line 3 and subtract Line 2 from Line 1a. If the result is less than $246, you can stop filling out the form.

- Continue to Line 4 and subtract Line 2 from Line 1b. This figure is vital for determining if there is an underpayment.

- Divide the result from Line 4 by 4 and enter it in each payment period under Columns a through d.

- In Line 6, indicate the estimated tax paid for each of the payment periods based on your payment records.

- Calculate your underpayment for each period using Line 9 by comparing your payments against the expected payments.

- If applicable, complete Part II to determine if any exceptions to the interest penalty apply.

- Once all sections are complete, review your entries for accuracy before proceeding to save, download, print, or share the form.

Complete your Form 1630 online now to ensure compliance with your tax obligations.

Yes, you can still file your 2017 taxes in 2023, but be mindful that there are limitations on refunds and potential penalties for late filing. You can use Form 1630 2017 to help correct any mistakes or omissions from your original filing. Ensure you gather all necessary documents to facilitate the process. US Legal Forms provides an excellent platform to access the forms and guidance needed for your tax filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.