Loading

Get State Of South Carolina Sc4868 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of South Carolina Sc4868 Form online

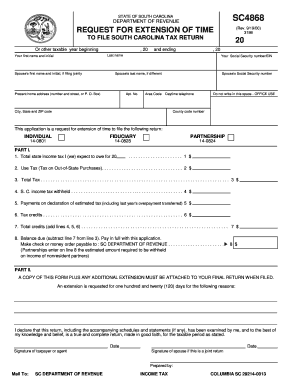

Filing the State Of South Carolina Sc4868 Form online provides an efficient way to request an extension of time for filing your tax return. This guide offers a clear and detailed walkthrough to help you complete the form accurately and effectively.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the SC4868 form and open it in the editor.

- Begin by entering your last name, first name, and middle initial in the designated fields.

- If filing jointly, include your partner's first name and middle initial. Ensure their last name is also provided if it differs from yours.

- Fill in your Social Security number or Employer Identification Number (EIN) as required.

- Enter your current home address, including the apartment number, if applicable, along with the city, state, county code, and ZIP code.

- Provide your daytime telephone number to the government for contact purposes.

- In Part I, declare the total state income tax you expect to owe by entering that amount on line 1.

- Report any use tax due on out-of-state purchases on line 2.

- Add the total amount of tax expected to owe on line 3.

- Specify any South Carolina income tax withheld on line 4.

- Document any payments made on declaration of estimated tax on line 5.

- Record any tax credits applicable on line 6.

- Calculate total credits by adding the amounts on lines 4, 5, and 6 for line 7.

- Subtract line 7 from line 3 and document any balance due on line 8. This balance must be paid in full with your application.

- In Part II, provide a brief explanation for the extension request and sign the form as required.

- Finally, save your changes, then proceed to download, print, or share the completed form as necessary.

Complete your forms online for a smooth tax extension process.

Filing a tax extension after October 15 in South Carolina is generally not allowable. The State Of South Carolina Sc4868 Form must be submitted by the original tax deadline to extend your filing time. However, you may still address any owed amounts or file your taxes outside the extension period, keeping in mind potential penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.