Get Form 4361 (rev. December 1999 ) - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 4361 (Rev. December 1999) - IRS - Irs online

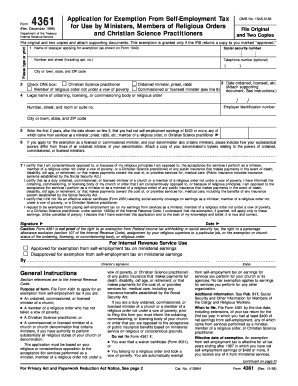

Filling out Form 4361 is an important step for certain religious professionals seeking exemption from self-employment tax. This guide provides a comprehensive, step-by-step approach to completing the form online, ensuring that users understand the requirements and processes involved.

Follow the steps to correctly fill out the Form 4361 online

- Press the ‘Get Form’ button to acquire the form and access it in your chosen editor.

- Carefully enter your name, as it appears on Form 1040, followed by your social security number, address, and optional telephone number.

- Indicate the date you were ordained, licensed, or commissioned by entering the appropriate date on the designated line.

- Select the appropriate box to identify your status: ordained minister, commissioned minister, Christian Science practitioner, or member of a religious order not under a vow of poverty.

- Provide the legal name and address of your ordaining, licensing, or commissioning body or religious order, along with their employer identification number.

- List the first two years after the date on line 3 in which you earned net self-employment income of $400 or more from related ministerial services.

- If applying as a licensed or commissioned minister, describe how your powers differ from those of an ordained minister of your denomination, and attach supporting documents if necessary.

- Certify that you are conscientiously opposed to accepting public insurance for services performed as specified, and confirm that you have informed your church of this.

- Sign and date the form, ensuring that all provided information is accurate to the best of your knowledge.

- Once completed, save your changes, download the form, and proceed to print or share it as required.

Complete your document online for a smooth filing process.

Filling out a withholding exemption form requires you to provide essential details, such as your name, address, Social Security number, and the reason for your exemption. After entering this information, ensure that you carefully review the instructions specific to the form to avoid any mistakes. Completing this process accurately is crucial for ensuring the correct amount is withheld from your paycheck. US Legal Forms can guide you with templates and examples to simplify this task.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.