Loading

Get What Is Pa40 1999 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Pa40 1999 Form online

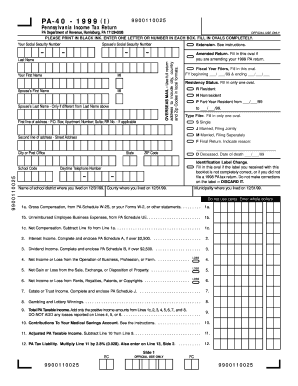

Filling out the PA-40 1999 form online is an essential step for individuals seeking to file their Pennsylvania income tax return. This guide provides a structured approach to help users navigate each section of the form efficiently and accurately.

Follow the steps to complete your PA-40 1999 form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering your Social Security Number. Ensure that you accurately enter your number in the given fields.

- Provide your name and the name of your partner, if applicable. Fill in the first and last names as requested. If your partner has a different last name, be sure to fill in that field as well.

- Complete your address information. Always use black ink and enter one letter or number in each box. Include any relevant details like apartment number or P.O. Box, followed by your city, state, and ZIP code.

- Indicate your residency status by filling in the appropriate oval. Choose from resident, non-resident, or part-year resident options based on your situation.

- Select your filing status. You can choose from single, married filing jointly, or married filing separately. Fill in the corresponding oval for your choice.

- For income details, accurately report your gross compensation and any unreimbursed business expenses as instructed in the income sections.

- Add your various sources of income, including interest, dividends, and any business losses. Be careful to only include positive amounts in your total taxable income calculation.

- Proceed to compute your tax liabilities and credits. Follow the instructions for calculating your tax due or overpayment accurately.

- Finally, review your entries carefully, save your changes, and ensure you have the option to download, print, or share the completed form as needed.

Complete your form online today to ensure timely submission and processing.

The Pennsylvania tax forgiveness credit is available for residents who meet specific criteria based on their income and family size. Typically, low-income families may qualify for this beneficial program, helping them reduce their tax liabilities. Understanding the requirements is key to taking advantage of this opportunity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.