Get Washington Sales Summary Fee Report Liq 162 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Washington Sales Summary Fee Report Liq 162 Form online

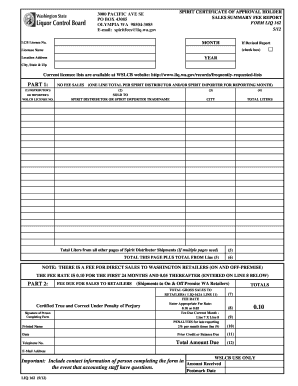

The Washington Sales Summary Fee Report Liq 162 Form is essential for Spirit Certificate of Approval holders to report their sales activities. This guide will provide you with clear steps to successfully complete the form online, ensuring compliance with state regulations.

Follow the steps to fill out the Washington Sales Summary Fee Report Liq 162 Form online

- Click ‘Get Form’ button to obtain the Washington Sales Summary Fee Report Liq 162 Form and open it in the editor.

- Fill in the license number. This is your Washington State Liquor Control Board (WSLCB) 6 digit license number.

- Enter the licensee name as registered with the WSLCB.

- Complete the location address field with your business address.

- Specify the reporting month and year for which the sales activity occurred.

- In Part 1, input the distributor's or importer's WSLCB license number and name, including the city and total liters sold to each.

- Provide the total liters sold from any additional pages, if applicable.

- For Part 2, calculate the total gross sales to retailers and input it, including the fee rate which is either 0.10 or 0.05 based on your licensing period.

- Determine the fee due by multiplying the total gross sales by the fee rate.

- Account for any penalties for late reporting in this section.

- Include any prior credits or balance due and calculate the total amount due.

- Finally, complete the certification by signing, printing your name, entering the date, contact number, and email address before saving, downloading, or printing the form.

Complete your Washington Sales Summary Fee Report Liq 162 Form online and ensure compliance with state regulations.

To obtain a Washington sales tax ID, you must register your business with the Washington Department of Revenue. You can do this easily online by providing some basic information about your business structure and operation. Once registered, you will receive a Unified Business Identifier (UBI), which serves as your sales tax ID. Don’t forget to keep track of your filings, including the Washington Sales Summary Fee Report Liq 162 Form, to stay compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.