Loading

Get State Bar Nevada Iolta Forms Needed

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Bar Nevada Iolta Forms Needed online

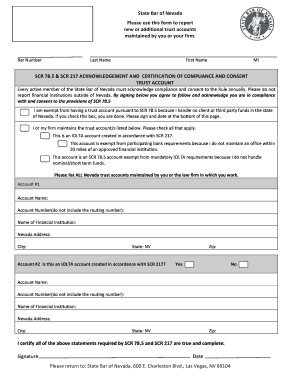

The State Bar of Nevada Iolta Forms are essential for reporting new or additional trust accounts maintained by you or your firm. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently online.

Follow the steps to fill out the State Bar Nevada Iolta Forms Needed online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your bar number in the designated field. This is crucial for the identification of your account.

- Fill in your last name, first name, and middle initial (MI) as required. Double-check for accuracy.

- Acknowledge compliance with SCR 78.5 & SCR 217 by reviewing the statement provided. You must sign below to confirm your consent.

- Indicate if you are exempt from having a trust account by checking the appropriate box. If you check this option, you can stop here and proceed to sign and date the form.

- If you maintain any trust accounts, check all applicable boxes relating to those accounts. This includes identifying the accounts that are IOLTA accounts or exempt from bank requirements.

- For each trust account, fill in the required details: Account Name, Account Number (excluding the routing number), Name of Financial Institution, Nevada Address, City, State (NV), and Zip code.

- Certify that all statements made are true and complete by signing and dating the form at the bottom.

- Once you have completed the form, you can save your changes, download it, print a copy, or share it as needed.

Complete your State Bar Nevada Iolta Forms online today!

Yes, law firms generally must file 1099 forms for payments made from IOLTA accounts on behalf of clients. This reporting is important for tax purposes and ensures transparency in financial transactions. Attorneys should consult the IRS guidelines and State Bar regulations to ensure compliance. For clear information regarding State Bar Nevada Iolta Forms Needed, you may find useful tools and resources on US Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.