Loading

Get Tax History Project

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax History Project online

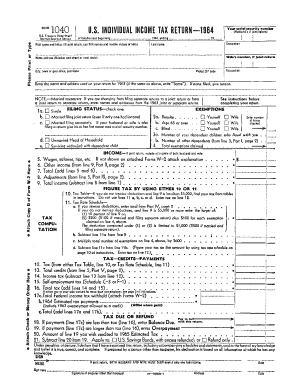

This guide provides clear instructions on how to successfully complete the Tax History Project form online. By following these steps, you will understand each section and field required for efficient filing.

Follow the steps to complete your Tax History Project form.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by filling in your first name and initial, as well as your last name. If you are filing a joint return, include the names and initials of both parties.

- Next, enter your social security number. If filing jointly, include your partner's social security number as well.

- Indicate your occupation and that of your partner if applicable.

- Provide your home address, including the street number, city or town, state, and postal ZIP code.

- In the section regarding the name and address used on your previous year's return, indicate if it is the same as above or write 'Same.'

- Select your filing status by checking the appropriate box, which may include options such as 'Single,' 'Married filing jointly,' 'Married filing separately,' or 'Unmarried head of household.'

- Complete the exemptions section by entering the number of boxes checked for yourself and your spouse, as well as for any dependent children.

- Proceed to the income section, where you will report total wages, salaries, and any other income you received.

- Calculate your total income and include any adjustments as detailed in the form.

- Utilize the tax computation section to determine the tax owed based on the income reported.

- Fill in any applicable credits and payments sections to finalize your tax obligations.

- If the total tax payments are less than the amount due, calculate and enter the balance owed. If they exceed the tax due, enter any overpayment and what you wish to apply it towards.

- Finally, sign and date your form. If applicable, both you and your partner must sign if filing jointly.

- Once all sections are complete, save your changes, and download or print the form for your records. Share the document if required.

Complete your Tax History Project form online today for a smooth filing experience.

Related links form

Yes, you can file past tax years electronically, though options may vary based on the tax software you choose. Many platforms, including US Legal Forms, allow you to file prior years electronically, which is convenient and expedited. Keep in mind that you may also need to mail in some documents, so ensure you check the requirements for each tax year with the Tax History Project for complete compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.