Get La8453 C

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the La8453 C online

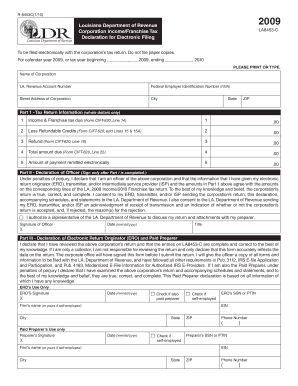

The La8453 C form is a critical document for submitting your corporation income and franchise tax declaration electronically with the Louisiana Department of Revenue. This guide provides you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the La8453 C online:

- Click ‘Get Form’ button to access the La8453 C form and open it in your online editor.

- Enter the name of your corporation in the designated field. Ensure that the name is spelled correctly as it appears in your official documents.

- Input the Louisiana Revenue Account Number. This number is essential for identifying your corporation within the state.

- Provide your Federal Employer Identification Number (FEIN) in the next field. This is necessary for federal tax purposes.

- Fill in the street address of your corporation accurately, including any suite or unit numbers.

- Next, specify the city, state, and ZIP code associated with your corporation's address.

- In Part 1, complete the tax return information by entering whole dollar amounts in the appropriate fields: Income & Franchise tax due, Less Refundable Credits, Refund, Total amount due, and Amount of payment remitted electronically.

- Once Part 1 is completed, proceed to Part II and sign the declaration as an officer of the corporation, confirming the accuracy of the inputs.

- Date your signature using the mm/dd/yyyy format.

- If applicable, fill out Part III concerning the Electronic Return Originator and Paid Preparer information, ensuring each section is completed and signatures acquired.

- Finally, save your changes, and choose to download, print, or share the La8453 C form as needed, ensuring you keep a copy for your records.

Complete your La8453 C form online today for efficient and timely submission.

The key difference between form 8879 C and form 8453 C lies in their purposes; form 8879 C is specifically for e-filing as a declaration of your electronically filed income tax return, while form 8453 C serves a broader role in authorizing e-filing and supporting documentation. Both forms are important for electronic tax submissions and ensuring compliance with IRS regulations. For a solid understanding of La8453 C, explore the comprehensive tools offered by uslegalforms to clarify these distinctions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.