Loading

Get Mo Form 4458 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo Form 4458 Instructions online

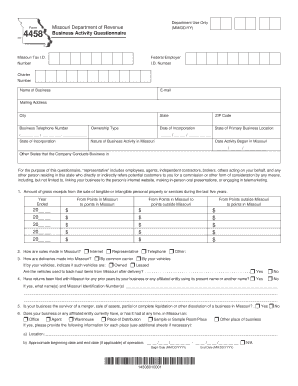

Filling out the Mo Form 4458 Instructions online can be a straightforward process when approached methodically. This guide provides clear step-by-step instructions to help users complete the questionnaire accurately and efficiently.

Follow the steps to complete the Mo Form 4458 Instructions online.

- Press the 'Get Form' button to download the form and access it digitally.

- Begin by filling in the 'Name of Business' section with the official name of your business.

- Select your 'Ownership Type' from the provided options, ensuring to check the appropriate box.

- Add the 'Address' of your business, including city, state, and ZIP code.

- Enter the 'Date of Incorporation' formatted as MM/DD/YYYY.

- Specify the 'State of Incorporation'.

- Indicate the 'State of Commercial Domicile'.

- Provide the 'Date Activity Began in Missouri' in MM/DD/YYYY format.

- Fill in the 'Principal Business Activity' section with a brief description.

- Input your 'Missouri Tax I.D. Number' and 'Federal I.D. Number', if applicable.

- Describe the 'Nature of Business Activity in Missouri' comprehensively.

- List your 'Charter Number' if it applies.

- Input the 'Business Telephone Number' in the correct format.

- Detail any 'Other States that the Company Conducts Business In' if applicable.

- Answer questions regarding deliveries, returns, offices, and other operations as prompted in the questionnaire.

- Complete sections regarding tangible property, accounts, advertising, contracts, and representatives as detailed in the form.

- Ensure to report any information about employees, services performed in Missouri, and financials as required.

- Conclude by adding your signature and printed name along with the date on the form.

- Finally, save your changes, and select options to download, print, or share the completed form as needed.

Start completing your Mo Form 4458 Instructions online today!

Yes, LLCs operating in Missouri must file an annual report to maintain good standing with the state. It's important to keep your business documents up to date, as failure to do so can lead to penalties. For a clear understanding of the filing process, you can refer to the Mo Form 4458 Instructions or explore resources on uslegalforms for assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.