Loading

Get Tn Form Inh 300

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tn Form Inh 300 online

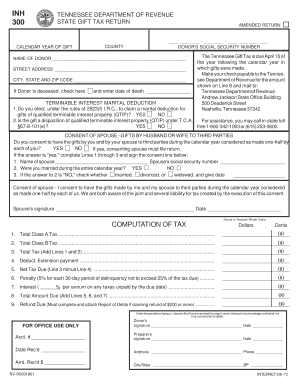

Filling out the Tennessee Department of Revenue's State Gift Tax Return, also known as Tn Form Inh 300, can be a straightforward process when you understand its components. This guide will walk you through each section of the form to ensure you complete it accurately and seamlessly.

Follow the steps to complete your Tn Form Inh 300 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the calendar year of the gift in the corresponding field. This indicates the year in which the gifts were made.

- Provide the county name where the donor resides. This is necessary for county-specific tax regulations.

- Input the donor's social security number securely in the provided field. This identifier is crucial for tax purposes.

- Enter the donor's full name, ensuring that it exactly matches the name registered with the Social Security Administration.

- Fill in the street address, city, state, and zip code of the donor. This information helps establish the donor’s residency.

- If the donor is deceased, check the designated box and enter the date of death to indicate the donor's status.

- Review the marital deduction questions carefully and select 'YES' or 'NO' where required. These questions pertain to terminable interest gifts.

- Provide the necessary consent details if signing on behalf of a spouse; this includes their name and social security number.

- Calculate and enter the total Class A Tax and Class B Tax in their respective fields. Ensure all computations are double-checked for accuracy.

- Deduct any extension payments and calculate the net tax due by subtracting the extension payment from the total tax.

- Include any applicable penalties and interest for late payments as outlined in the instructions.

- Total all amounts due and any possible refunds, ensuring that you maintain accurate records per the instructions.

- Don’t forget to sign and date the form at the end, making it legally binding.

- Finally, save your changes, download, print, or share the form as needed based on your requirements.

Complete your Tn Form Inh 300 online to ensure compliance with Tennessee tax regulations.

Absolutely, if you operate an LLC in Tennessee, you must file an annual report. This involves submitting the TN Form Inh 300, which provides necessary information to the state. Keeping up with this obligation helps keep your business compliant and prevents potential issues down the line.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.