Get Tax Information Authorization And Power Of Attorney For Representation Oregon

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Information Authorization and Power of Attorney for Representation Oregon online

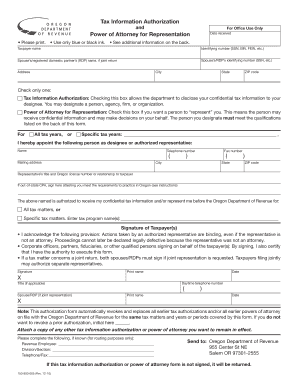

Filling out the Tax Information Authorization and Power of Attorney for Representation Oregon form is essential for anyone needing to authorize a person or entity to represent them regarding their tax matters. This guide will provide you with clear, step-by-step instructions on how to complete this form online, ensuring you understand each section and its requirements.

Follow the steps to fill out your form online successfully.

- Press the ‘Get Form’ button to access the Tax Information Authorization and Power of Attorney for Representation Oregon form and open it in your preferred editing tool.

- Begin by entering the taxpayer's name in the designated field. This should be the name of the individual or entity requiring representation.

- Next, provide the identifying number, which might be the Social Security Number (SSN), Business Identification Number (BIN), or Federal Employer Identification Number (FEIN). Choose the appropriate one based on the taxpayer's status.

- If filing a joint return, include the spouse's or registered domestic partner’s (RDP) name and their identifying number in the corresponding sections.

- Fill in the current address, including city, state, and ZIP code, where the taxpayer can be contacted.

- Select one option by checking the box: ‘Tax Information Authorization’ grants access to confidential tax information, while ‘Power of Attorney for Representation’ allows the designated person to make decisions on behalf of the taxpayer.

- Specify whether the authorization applies to all tax years or specific tax years by selecting the appropriate option.

- Appoint a representative by entering their name, fax number, telephone number, and mailing address. This should include their state, city, and ZIP code.

- Indicate the representative's title and Oregon license number or their relationship to the taxpayer.

- If the representative is an out-of-state CPA, they must sign the form attesting to their qualifications to practice in Oregon.

- In the signature section, both the taxpayer and their spouse/RDP (if applicable) must sign and date the form. Ensure you provide a daytime telephone number.

- If there are any prior authorizations you wish to continue, you can initial the specific field to indicate that. If not, this form will revoke all previous authorizations.

- After completing all fields, review the information for accuracy, then save your changes. You may choose to download, print, or share the form as needed.

Complete your form online to ensure timely processing of your tax representation.

No, you do not need a lawyer to create a power of attorney in Oregon, but having one can provide clarity and ensure your document meets all state requirements. If your situation is complex or if you have concerns about your rights, consulting a lawyer can be beneficial. However, you can easily draft a power of attorney using resources like uslegalforms, which provides straightforward templates and instructions that simplify the process. This way, you can confidently establish your power of attorney without legal hurdles.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.