Loading

Get Fillable Cr Q2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Cr Q2 Form online

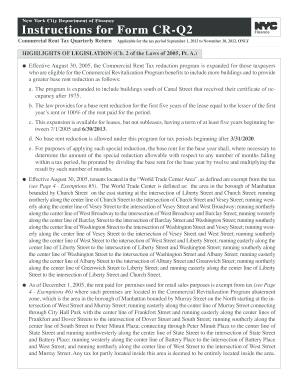

This guide provides clear instructions on how to complete the Fillable Cr Q2 Form online. Whether you are familiar with tax forms or are new to the process, this comprehensive guide will support you in filling out the necessary information accurately.

Follow the steps to complete the Fillable Cr Q2 Form online

- Press the ‘Get Form’ button to access the Fillable Cr Q2 Form and open it in your online editor.

- Begin by entering the address, zip code, and block and lot number of each taxable premises where the annualized gross rent exceeds $200,000.

- Determine the total gross rent paid for each premises and record this information on the corresponding line, following the guidelines for what constitutes rent.

- If applicable, enter the amount of rent attributable to residential use in your home on the designated line.

- Record any amounts received from subtenants as rent, making sure to include the subtenant’s details for accurate processing.

- List any other allowable deductions from gross rent on the corresponding line and attach a detailed schedule of these deductions.

- Calculate the base rent before the 35% rent reduction and enter this amount on the appropriate line.

- Apply the 35% rent reduction to your base rent, following the calculation guidelines provided.

- Determine the final base rent subject to tax by subtracting the rent reduction from the base rent.

- If your occupancy or use of the premises was not for the full three-month period, complete the annualization lines to calculate the appropriate values.

- Once all fields are filled, review your entries for accuracy, and proceed to save changes, download or print your completed form as necessary.

Complete your Cr Q2 tax return online to ensure timely submission and compliance.

To obtain an ITR form, you can access it directly from the IRS website or use trusted online platforms like USLegalForms. They offer the Fillable Cr Q2 Form along with a variety of other tax documents. By choosing their service, you can ensure that you are using the correct and most up-to-date forms for your needs. Don't hesitate to explore their resources for a smooth filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.