Get Denver Petition For Abatement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Denver Petition For Abatement Form online

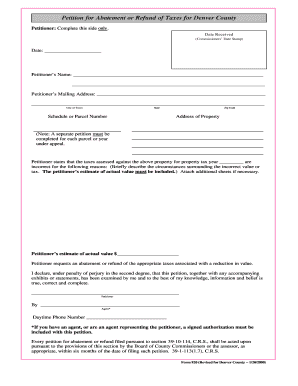

Filling out the Denver Petition For Abatement Form online can seem daunting, but with clear guidance, you can navigate it easily. This form is essential for individuals seeking an adjustment or refund of property taxes assessed against their property.

Follow the steps to complete the form online effectively.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Fill in the date received, which will be stamped by the commissioners once your petition is submitted.

- Provide your name in the 'Petitioner’s Name' section, ensuring that it matches the legal name associated with the property.

- Complete the 'Petitioner’s Mailing Address' section accurately with your street address, city or town, state, and zip code.

- Enter the schedule or parcel number for the property in question, which can typically be found on your tax documents.

- Describe the address of the property for which you are requesting an abatement or refund.

- State the specific property tax year for which you believe the taxes are incorrect.

- Clearly articulate the reasons why you believe the assessed value or tax is incorrect. Include your estimate of the property's actual value.

- If more space is needed for your explanation, attach additional sheets as necessary.

- Sign the petition to declare under penalty of perjury that the information provided is true, correct, and complete.

- If you are using an agent, ensure to include a signed authorization and have them fill out their section when necessary.

- Finally, review all entered information for accuracy before saving your changes, and choose to download, print, or share the completed form.

Complete your Denver Petition For Abatement Form online today to ensure your property tax concerns are addressed promptly.

Typically, individuals or entities experiencing financial difficulties, unexpected emergencies, or significant changes in personal circumstances may qualify for a tax abatement. Each situation is assessed on a case-by-case basis, so it's important to provide detailed explanations in your Denver Petition For Abatement Form. Consulting with a tax professional can also clarify eligibility and improve your chances of approval.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.