Loading

Get City Of Dayton Oh Fillable Form D1 X

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the City Of Dayton Oh Fillable Form D1 X online

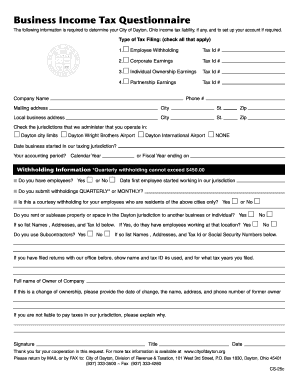

Filling out the City Of Dayton Oh Fillable Form D1 X online is an essential step in determining your income tax liability within the jurisdiction. This guide will provide you with clear, step-by-step instructions to complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to access the D1 X form and open it in your preferred document editor.

- Begin by indicating the type of tax filing that applies to you. Check all relevant boxes for Employee Withholding, Corporate Earnings, Individual Ownership Earnings, and Partnership Earnings. Make sure to enter the corresponding Tax IDs.

- Enter your company name and contact information, including your phone number and mailing address (City, State, and Zip code). Additionally, provide the local business address along with its City, State, and Zip code.

- Next, check the jurisdictions in which your business operates by selecting Dayton city limits, Dayton Wright Brothers Airport, Dayton International Airport, or NONE.

- Input the date your business started working within the taxing jurisdiction and indicate your accounting period, choosing either Calendar Year or Fiscal Year.

- For withholding information, answer whether you have employees by selecting Yes or No. If applicable, provide the date your first employee started working in the jurisdiction.

- Indicate whether you submit withholdings quarterly or monthly. If you have a courtesy withholding for employees residing in designated cities, respond accordingly.

- If you rent or sublease property in Dayton jurisdiction, specify the names, addresses, and Tax IDs of those renting and indicate whether they have employees there.

- If you use subcontractors, list their names, addresses, and either Tax IDs or Social Security numbers as required.

- If you have previously filed returns, provide your name along with the Tax IDs used and the tax years filed. Include the full name of the company owner.

- If there has been a change of ownership, give the date of change along with the former owner's name, address, and phone number.

- If you are not liable to pay taxes in the jurisdiction, provide a detailed explanation.

- Finally, sign the form, indicate your title, and date it. Review your entries for accuracy before finalizing.

- Once completed, you can save your changes, download, print, or share the form as needed.

Start completing your City Of Dayton Oh Fillable Form D1 X online today for accurate tax processing.

Ohio's adjusted gross income usually includes wages, interest income, business revenue, and retirement income, minus certain deductions. Understanding what constitutes your AGI helps in more accurately calculating your tax liability. For precise information on what to report, consult the City Of Dayton Oh Fillable Form D1 X, which can effectively facilitate this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.