Loading

Get Form Ft-941.1 - Tax Ny

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form FT-941.1 - Tax Ny online

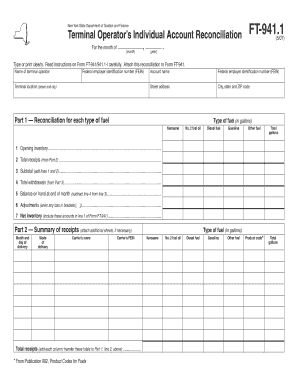

Filling out Form FT-941.1 is essential for terminal operators to reconcile their individual account for fuel types. This guide will provide clear steps to complete the form online, ensuring accuracy and compliance with New York State tax regulations.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the terminal operator and the federal employer identification number (FEIN) in the designated fields.

- Provide the terminal location, including the street address, city, state, and ZIP code.

- Proceed to Part 1 — Reconciliation for each type of fuel. Fill in the types of fuel you are handling and their corresponding gallons in the provided sections.

- For line 1, input the opening inventory figures of each fuel type. Make sure to be accurate to avoid discrepancies.

- In line 2, enter the total receipts based on the summary from Part 2 of the form.

- Calculate the subtotal by adding lines 1 and 2 together. This total will be entered in line 3.

- For line 4, input the total withdrawals from Part 3 based on your records.

- Line 5 requires you to find the balance on hand at the end of the month by subtracting line 4 from line 3.

- If there are any adjustments, enter loss figures in brackets on line 6.

- Calculate the net inventory for line 7, which includes amounts from line 1. This total will be important for your records.

- Move on to Part 2 to summarize receipts. Document the month and day of delivery, the mode of delivery, the carrier's name, and their FEIN.

- Add the total receipts for each category of fuel and transfer this information to Part 1, line 2.

- In Part 3, summarize withdrawals, listing each method of withdrawal and the corresponding totals for trucks, tank wagons, and other methods.

- Finally, ensure all sections are filled accurately and save your changes. You can download, print, or share the filled form as needed.

Complete your Form FT-941.1 online today to ensure compliance and simplify your tax obligations.

Yes, federal Form 941 can be filed electronically using IRS e-file options. Many tax preparation software services offer electronic filing, making submission faster and more efficient. Using electronic methods helps ensure your return is processed quickly, especially for obligations related to Form FT-941.1 - Tax Ny.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.