Loading

Get Maryland Property Tax Credit Instructions Htc 60 2005 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maryland Property Tax Credit Instructions HTC 60 2005 Form online

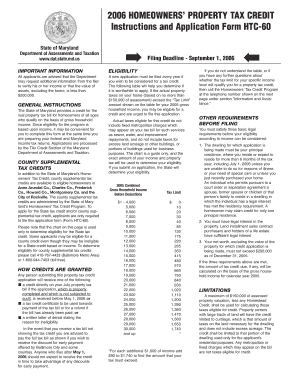

This guide provides clear instructions on completing the Maryland Property Tax Credit Instructions HTC 60 2005 Form online. It is designed to assist users of all experience levels in navigating the application process efficiently.

Follow the steps to complete your tax credit application online.

- Click ‘Get Form’ button to download the Maryland Property Tax Credit Instructions HTC 60 2005 Form and open it in your preferred editing tool.

- Begin by filling in your personal information in the designated fields, including your name, Social Security number, and contact information.

- Provide details about your principal place of residence, ensuring to specify if it is your primary home where you reside for more than six months of the tax year.

- List all non-dependent residents of your home, providing their names if applicable. If there are none, write 'NONE' in that section.

- Report your total gross household income in the appropriate category, ensuring you include all sources as specified, such as wages, rental income, and social security benefits.

- Complete the line regarding reasonable fixed charges for room and board, indicating if applicable. If none, write 'NONE' and report the gross income of those listed in the previous item.

- Sign the form, confirming the accuracy of the information provided under the penalties of perjury, and date your signature.

- Before finalizing, double-check that you have included a copy of your complete federal income tax return, including all schedules, if required.

- Once all entries have been completed, you can save your changes, download a copy of the filled form, print it out, and share it as needed.

Ensure your Maryland Property Tax Credit application is accurate and submitted by the deadline. Begin the process online today!

Filing a Form 1 annual report in Maryland requires you to complete the necessary sections accurately, providing your property specifics and tax information. Make sure you follow the instructions detailed in the Maryland Property Tax Credit Instructions Htc 60 2005 Form for a smooth filing process. If assistance is needed, uslegalforms can be a helpful resource to navigate the requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.